GOZNAK: THE INVISIBLE RUSSIAN INVASION

When, at the end of February 2022, the United States announced sanctions against Russia to force Putin to stop the war, and then forced the European Union and other allies to follow suit, they above all performed an act of propaganda, which, moreover, was understandable. Is it possible that no one thought that Putin knew this would happen, and that he had not prepared himself? The duration of the war proves that Russia miscalculated Ukraine’s resilience and the West’s compactness in supporting it humanly, economically and militarily, but was prepared for a long East/West confrontation.

Not only has there been no economic collapse, but, on the contrary, the war is also enriching Russia, as are other Western industrial and commercial sectors related to energy and arms production. Moscow’s trade with foreign countries has been only superficially disturbed, but, the more time passes, the less the sanctions work, which only affect the oligarchs and, therefore, from the point of view of Russian domestic politics, help Putin to strengthen his own power – as also show the many suspicious suicides of oligarchs in Russia[1].

Well, Russia has spent the last ten years building an alternative currency, trade and military interchange system to that of the West – one on which sanctions do not have the slightest negative influence, but on the contrary become the main reason for its growth, because more and more national economies are joining it and, thanks to this, experience a growth in their gross domestic product. Not only that. While the West, over the past centuries, has been guilty of horrendous crimes against the poorest countries (which are, however, the repositories of most of the planet’s raw materials), and is now granting loans with loan-shark clauses to countries already too indebted to have a choice, demanding profound changes in the societies, governments and traditions of the countries supported by the International Monetary Fund, Russia has no past to be forgiven and shows no interest in creating capestro clauses or demanding democracy and popular consensus.

Putin and his leaders have not invented anything new, but they have replicated the system created by National Socialism and German industry in the interval between the two world wars and after the birth of NATO: having control over the exchange of currencies and the printing of banknotes amounts to a formidable and invisible instrument of blackmail. Germany, already at the end of the 19th century[2], developed this concept with the largest mint in the world, Giesecke & Devrient, which was the big winner in the Asian and African wars of independence[3], and then in the Yugoslav civil war[4]. Russia then arranged for its mint, Goznak, to take the place of its competitors. And it succeeded.

History of the Russian Mint

Prince and Chamberlain Alexander Nikolaevich Khovansky, Director of the Russian State Bank and the State Securities Procurement Office[5]

Goznak JSC Moscow is the Mint of Russia: it is responsible for the production of security products, including banknotes, coins, stamps, identity cards, secure documents, state orders and medals[6]. It is a joint-stock company whose sole shareholder is the State, represented by the Federal Agency for State Property Management (Rosimuschestvo)[7]. So Goznak is responsible for all Russian passports, including those distributed in the occupied regions of Ukraine, as well as military and intelligence documents. The distribution of passports plays an important role in the attempt to ‘Russify‘ and destabilise Ukraine. For supporting aggression against Ukraine, Goznak is subject to international sanctions by all EU countries, the UK and several other countries[8] (including Switzerland[9] and New Zealand[10]).

The company has eight locations: seven production sites (the Moscow Printing Works, the Moscow Mint, the Moscow Mint, the St. Petersburg Mint, the St. Petersburg Paper Mill, the Perm Printing Works, the Krasnokamsk Paper Mill) and one research institute (the Goznak Research Institute)[11].

For over two centuries, Goznak has been one of the flagships of modern Russia: for over a century, the mint has been at the forefront of technology, manufacturing and even art. Giesecke & Devrient, the historical German mint that, until the end of the Cold War, was the company that printed the currencies of most countries on earth, also playing a key role in financial espionage: such as when, in the wake of a political decision by the West against dictator Robert Mugabe, it caused the bankruptcy of Zimbabwe, or artificially supported Francisco Franco’s pro-Nazi government in Spain[12]), was born half a century later[13], and only established itself in the early 1900s, during the financial collapse following the 1929 crisis[14].

Goznak, on the other hand, was founded by a decree of Emperor Alexander I in 1818 as the Expedition for the Purchase of State Papers[15] (EZGB), under the control of the Ministry of Finance. The first director was Prince Alexander Nikolaevich Khovanskiy, a senator and bank director, who was in charge of EZGB for 32 years. In May 1839, he opened an electroforming workshop for the reproduction of copper plates, the first in the world, with the help of Boris Semyonovich Jacobi, the famous Russian physicist and engineer who had announced the invention of electroforming a year earlier[16].

In 1857, the first Russian postage stamps were printed on special paper with a watermark made by EZGB for stamp papers. In 1861, Fyodor Fyodorovich Winberg arrived at the helm of the company and was in charge for 28 years. Under his leadership, the company grew considerably and began to diversify. In 1863, the German-Russian artist and photographer Georgiy Nikolaevich Skamoni developed a method for producing galvanic copies of gelatin and metal reliefs, which opened up almost unlimited possibilities for the reproduction of text and image elements – an invention of his, his mentor (Jacobi) and his assistant, the scientist Dmitriy Ivanovich Mendeleev[17].

Boris Borisovich Golitsyn[18]

In 1878, electricity was introduced for lighting and technical purposes: Wilhold Theophil Odner, inventor of the arithmometer, built a machine for the automatic numbering of banknotes (which were previously numbered manually) for EZGB. In 1884, EZGB received the right to produce postage stamps for the Zemstvo post office, and within a few years it developed five official stamp standards[19]. In 1886, Ivan Ivanovich Orlov, creator of the printing press of the same name, joined EZGB and, in 1890, proposed a new multi-colour printing method that is still used today. In 1891, after graduating in Physics in St Petersburg, Alexander Alexandrovich Popovitskiy, a pioneer of multi-colour reproduction, came to work at EZGB[20].

In the late 19th and early 20th century, banknotes with the portrait of Peter the Great (500 roubles) and Catherine II (100 roubles) were produced. The portraits are engraved on the watermark – an example of high art, distinguished by the relief of the image. In 1889, the staff of EZGB grew to 2400 persons – one of the largest enterprises in Russia[21]. In 1899, Prince Boris Borisovich Golitsyn (scientist, academician, physicist, father of seismology and seismometry, author of the secondary school reform project) was appointed administrator. Descendant of a noble and ancient family, he graduated from the Naval Academy and then the University of Strasbourg, and was one of the most cultured and talented people of his time[22]. From 1899 to 1905, he was a director of the company: a period that is referred to as Goznak’s ‘silver age’.

Prince Golitsyn transformed EZGB into a model factory for the production of artistic and technical paper, equipped with the best equipment of the time[23]. The eight-hour working day was established in all departments, a school was opened where students are trained in papermaking, phototechnology and printing. The EZGB has its own infirmary, shop, theatre and kindergarten. Golitsyn expanded the engraving department, which is the best printing shop in Russia[24].

According to Prince Golitsyn, EZGB serves the education and cultural and aesthetic development of the peoples of Russia. The idea is to publish Russian classics and popular books on good paper, illustrated by Russian artists. Golitsyn recruits prominent artists and scientists and books of the highest artistic level are published, such as the famous Russian fairy tales illustrated by the famous book illustrator Ivan Bilibin[25]. Books, albums, calendars and postcards published during the period when the EZGB was run by Prince Golitsyn are among the rarest Russian editions today[26].

Between 1897 and 1914, the amount of banknotes in circulation was entirely backed by gold. Silver coins were auxiliary means of payment, and banknotes were freely exchanged for gold coins, in circulation in large quantities – these were years of economic prosperity[27]. EZGB provided not only for the needs of the state, but also for the orders of public and private institutions for the production of securities, bonds, cheques, stamped paper, et cetera. Its original name the company received after the October Revolution in 1917 (‘Red October’)[28], it was transformed into the Department of Government Paper Factories, abbreviated to Goznak.

Siegfried Otto (first left), undisputed leader of Giesecke & Devrient during and after the Second World War, who led the world’s most important mint before the success of Goznak[29]

The Soviet reform of EZGB-Goznak is dated 6 June 1919, and Goznak’s board of directors moved to Moscow, headed by a comrade-in-arms of Lenin, T.T. Enukidze[30]. Until the end of the USSR, Goznak remained a state enterprise with powers limited to the national territory[31] – a situation that changed in 1991, after the collapse of the Soviet Union, and many republics declared themselves independent states. Some of them began to introduce their own banknotes, while others continued to remain in the ruble zone[32].

Under the leadership of L.V. Alekseev, the Goznak mints were equipped with new modern equipment. Alekseev was a printer, foreman, workshop manager and, after a period as a party member, returned to Goznak, and was thus a man of the Soviet apparatus[33]. In the new geopolitical design of Eastern Europe, Goznak, as of 26 August 2005[34], has become a powerful political instrument to force those states that have chosen independence to remain tied to the new Russia[35]. New ones, such as GSM cards, telephone cards and ATMs, have been added to the classic products[36]. Arkady Vladimirovich Trachuk has been serving as the general director of Goznak since October 2002 (coming from the energy industry[37]) and becoming, as a university professor, the repository of the new management doctrine of the Russian mint[38].

Other’s money

On 26 January 2017, Vladimir Putin presents Arkady Trachuk, general director of Goznak, with the Order of Friendship, a high state honour[39]

Thanks to Alekseev, and the support he enjoys with President Putin, the company has become one of the leading suppliers in the global paper and banknote market. In 2013, Goznak exported more than 1 billion banknotes a year, which are in circulation in 10 countries, including Cambodia, Guatemala, Lebanon, Malaysia and Yemen. In addition, the company exports around 5,000 tonnes of banknote paper and sells its technologies (to Indonesia and Egypt[40]). More than 20 countries are new customers of Goznak’s technicians, including Indonesia and Nigeria, as well as several banknote manufacturers in Germany, France and Canada[41].

The strategy is the same as that of Giescke & Devrient: deliver an official quantity (agreed with the client) of banknotes and keep one more or less secret to interfere with the economy of the country in question[42] – the difference being that the German mint hid its money in Switzerland, and Goznak hides it in the United Arab Emirates[43]. Since 2015, Goznak has been working on important orders in Africa, including the production of banknotes and coins for the Republic of Angola[44]. The diplomatic result is there for all to see: Isabel Dos Santos, Africa’s richest woman and daughter of former president José Eduardo Zedu Dos Santos, has taken a Russian passport and moved to the Black Sea shore[45].

The company completed an upgrade of the security complex and the production and delivery of banknotes to Rwanda[46]. In April 2016 Goznak presented a project for Laos, which was switching to the new biometric passports – produced by Goznak. The customer is so pleased that it has convinced its embassies in four other countries to adopt the same technology: the United States, Australia, Thailand and France[47]. The company offers the customer a complete ‘turnkey’ solution, with equipment and software for personalising the passports themselves[48].

Which does not prevent Goznak from having the know-how to print original passports from those countries… and anyone can understand what it means if Moscow prints American identity documents. The cooperation contracts between Goznak and the central banks of other countries show how Russia has been building an important network of relations for some time: almost all African countries have sided with Putin (or remained neutral) and, instead of imposing sanctions, negotiate the emergence of new economic, trade and military agreements[49]. And a few days ago came the news that the Russian Foreign Ministry is preparing to open new embassies in several African countries[50].

From 2020, Russia prints banknotes for Yemen. In June 2020, the Russian Foreign Ministry spokesman was asked to comment on reports that separatists in Yemen had blocked a convoy carrying 64 billion reais (around USD 225 million[51]) in banknotes printed for Yemen by Goznak. “The aforementioned incident took place in the southern Yemeni capital of Aden. We can confirm that, in accordance with the contract signed in 2017, Goznak is printing new banknotes for that country,” he said. “This is a purely commercial transaction,” he added[52].

Digital passports of India – produced exclusively by Goznak[53]

Friendly relations between Yemen and Russia date back to 1928, and were strengthened by an official agreement in 1955[54]. The USSR actively supported both the Yemen Arab Republic and the People’s Democratic Republic of Yemen. In doing so, it has provided them with considerable material assistance free of charge. Yemen responded by supporting Russian foreign policy initiatives, including draft resolutions at the UN, as well as Russian candidates in the governing bodies of the UN and other international organisations. Although most joint initiatives were discontinued with the outbreak of the civil war in 2014 and the Russian diplomatic presence ended in December 2017, the alliance between the two countries continues, under the radar, through the printing of currency and thus direct support for the country’s economy[55].

In 2009, Yemen announced that it was buying fighter jets, helicopters and wheeled vehicles from Russia. Similar agreements were reached in 2013-2014. However, due to the arms embargo, in force since 2015, these contracts have been frozen, and there are no prospects for their implementation. Another important aspect that Russia takes into account is territorial. Yemen is strategically advantageous in the region and undoubtedly becomes particularly important in the context of Russia’s long-term interests in the Middle East[56]. On the other hand, it should be considered that Russia is not the only country that claims to strengthen ties with Yemen. Egypt, Qatar, the United Arab Emirates, Iran, Turkey and Saudi Arabia also have their own interests in the country. And, unlike Russia, they are often more successful.

In 2018, Goznak’s capacity allows it to produce 11,000 tonnes of banknote paper per year, print up to 7 billion banknotes and mint 3.5 billion coins, in order to meet orders not only from the Bank of Russia, but also from other central banks. Exports account for almost a fifth of turnover[57]. To date, Goznak’s net worth is about 44 billion roubles (558 million euro)[58]. And the war has not changed anything, quite the contrary.

In April 2022, a Goznak spokesman confirmed that ‘At the moment, Goznak is fulfilling all existing contracts‘. The details of the contracts are a trade secret, which brings the treasury tens of millions of dollars annually. According to public sources, Goznak prints money for Colombia, Angola, Rwanda, Malaysia, Laos, Lebanon, Yemen, Guatemala, Venezuela and a number of neighbouring countries. In total, the products (banknotes, coins, banknote paper, technology) were supplied to more than 30 countries worldwide. As far as coins are concerned, today the company is working on orders from nine countries, including Madagascar, Thailand, Kuwait, Zambia and Colombia[59]. ‘For our banknotes, all materials are domestic,’ says collector Oleg Pakhmutov, ‘But for banknotes printed on commission, some elements can be licensed or imported. For example, the security strips‘[60].

After all, the European currency printing market ‘is as politicised as the arms market’, explains Arkady Trachuk, general director of Goznak. “That is why we do not and will not have any orders for the euro. However, we supply paper to European banknote factories, which use it to fulfil their orders for other countries“[61]. Since 2016 Russia has been printing money for Libya’s central bank, part of which has been used to finance General Haftar’s LNA[62]. Washington accuses the Kremlin of undermining the Libyan state with counterfeit banknotes and destabilising the country’s economy[63], but this does not change anything, because all warring parties recognise the banknotes printed by Goznak[64].

What the exit from SWIFT entails

Arkady Trachuk shows the commemorative banknote for the 2018 FIFA World Cup[65]

What has been explained so far implies that Russia, if driven by necessity, can operate like a Malagasy company in Madagascar, Thai in Thailand, and so on. It does not need access to local national credit, because it has sufficient cash reserves to move in the short term without it being noticed. But this, in itself, is not enough, because the West can block the global money transfer system: in February 2022, one day after the invasion, Bulgaria proposed to block Russia’s SWIFT channels and ordered the freezing of the Russian Central Bank’s assets – an example later followed by the European Commission[66], so that by March 2022 the other EU countries had blocked the SWIFT connection with Russia[67].

What does this mean? SWIFT stands for Society for Worldwide Interbank Financial Telecommunications. It is a reliable international system for the transmission of financial messages between banks. It is used to send postal money orders and money transfers. This enables banks and their customers to transfer funds worldwide. SWIFT was created in 1973 by 248 banks from 19 countries. Today, more than 11,000 financial institutions from 200 countries have joined it, including Russian banks. The system is cooperative, SWIFT is owned by all participants, who finance its operation[68].

Blocking SWIFT alone is not enough: there is also the clearing system, i.e. the system that calculates in real time the movement of currency in and out of every country, the quantities of every currency exchanged on the market in every part of the world, and that regulates all global interchange, and was born with a 1930 agreement and the foundation, in Basel, of the BIS Bank for International Settlements[69]. Thanks to the BIS, throughout the Second World War banks all over the world did business in gold[70], with each other, regardless of whether they were allies of the United Kingdom or Germany[71].

Over the years, with the dizzying increase in daily trading volumes and, subsequently, the digitisation of transfers, international clearing systems came into being. In particular, the two largest, Euroclear and Clearstream (both of which have blocked accounts on the Russian side of these companies, called NSD[72]). Although based in Brussels and Luxembourg respectively, they operate in the UK and are partly subject to UK jurisdiction. Most issues of debt securities are governed by English law[73].

That said, Russian bonds, if they are physically located outside of Russia, are still exempt from sanctions, and through the nations printing currency from Goznak continue to have a daily relationship with the National Clearing Centre (NCC) of the Russian Federation, which has not been affected by the sanctions, and whose volumes, although declining since the beginning of 2022, are still impressive[74]. In early June 2022, the EU imposed sanctions on the Russian National Settlement Depository (NSD). The Central Bank estimates the amount of Russian blocked assets in the NSD at the end of November 2022 at 6 trillion roubles (more than USD 80 billion)[75].

For the 200th anniversary Goznak issued a banknote depicting those who made it famous: Boris Golitsyn ①, Ivan Bilibin ②, Augustin Betancourt ③, Boris Yakobi ④, Ivan Dubasov ⑤ and Ivan Orlov ⑥[76]

Euroclear lost part of its revenues due to the cessation of operations with Russia. But the loss was ‘more than offset’ by the gains on the investments of the frozen assets, which enabled the company to achieve a record result. Euroclear International Finance Group’s net profit for 2022 was EUR 1.2 billion, of which EUR 597 million came from investment gains on frozen Russian assets, according to the company’s report. Compared to 2021, Euroclear’s profit increased by 162%, the company specified[77].

In August, the European Commission announced that Russian assets can be unfrozen subject to authorisation by the authorities of the countries where the foreign clearing houses are registered[78]. In December, regulators in Belgium and Luxembourg issued such authorisations[79], after which NSD and some Russian brokers applied for unblocking. These applications are now being examined[80]. In mid-February 2023, the first refusals to unblock arrived from the EU bodies[81].

Meanwhile, Kazakhstan’s brokers and banks, despite the sanctions, are buying up Russian government debt from those who no longer know how to dispose of it. The amount of transactions from March to December 2022 is about KZT 641.1 billion (USD 1.4 billion). 48.7 per cent of the purchases came from Kazakhstan and another 41.4 per cent from Russia. Buyers from other countries included representatives from the United Arab Emirates and Slovakia[82].

In order to circumvent sanctions, Russian companies have started to exchange the Eurobonds frozen in foreign deposits for substitute bonds, which allow the recovery of bond payments to Russian investors. The replacement bonds are denominated in foreign currency, but are settled through the Russian payment infrastructure – in roubles at the Bank of Russia’s exchange rate on the date of payment. As of 21 October 2022, the four largest Russian companies have taken the opportunity to issue replacement bonds: Gazprom, LUKOIL, Sovcomflot and Metalloinvest[83].

In short: Putin did not start a war, knowing from the outset that he would be hit by international economic sanctions, without having prepared himself with simple and efficient solutions that do not need complex, and easy to block, operations, such as those of the ‘oil for food’ scandal at the time of the embargo against Iraq in 1995[84]. This is very important to understand what Russia’s exit from SWIFT brings: domestic transactions are not affected in any way. For international ones, Russia created SPFS – its own SWIFT circuit – in 2014[85].

Western advertising to try to prevent SWIFT customers from switching to SPFS[86]

Today, almost 400 banks and companies in 12 countries are connected to the SPFS. For bank customers, there is no difference, because there are banks in the SPFS system that are also in SWIFT and therefore complete the transaction for those under embargo: the only difficulty that may arise is when paying with ATMs issued by banks under sanctions, but only when paying abroad or in foreign online shops[87]. So the sanctions are only affecting the most ignorant people, who, especially in Russia, turn to fraudsters to move their money and then find themselves robbed of everything[88].

SPFS is attractive to nations affected by international economic sanctions, such as Iran. Last March, Lavrov declared that Moscow and Tehran would cooperate to circumvent sanctions, Mohsen Karami, deputy governor of Iran’s Central Bank, replied: ‘Iranian banks no longer need to use SWIFT with Russian banks, which can be used to open letters of credit and transfers or guarantees’. According to Karami, Iranian banks abroad and foreign banks connected to the Russian national banking messaging system can exchange messages with Iranian banks. This includes 100 banks in 13 other countries[89].

In June 2022, the heavily sanctioned VTB Bank relaunched the possibility for its customers to send local currency transfers to China. The transfers will bypass the SWIFT system. ‘The new reality is leading to a massive rejection of the use of dollars and euros in international payments. To use national currencies effectively, we have to create and develop alternative SWIFT payment systems. We are the first Russian bank to create an alternative cross-border bank transfer service with China and within the next year we expect to increase the volume of these transactions fivefold‘[90].

Not least because, in parallel, China also has its own system called CIPS (Cross-border Interbank Payment System), which allows payments in yuan, China’s local currency. From July 2022, more and more Russian banks will connect to this system[91], thus opening the door to the Chinese currency as an international currency. Russian companies are using the yuan to settle most of their international trade, with the implicit effect of strengthening the Chinese currency[92]. In recent weeks, the yuan-ruble pair has been the most traded on the Moscow Stock Exchange. Aluminium giant UC Rusal was the first company to issue yuan bonds in Russia, followed by other commodity exporters such as oil company Rosneft. Most of them trade with China and can use yuan for day-to-day business, e.g. to pay bills[93].

And so it is that the Moscow branch of the Industrial and Commercial Bank of China (ICBC), the world’s largest state-owned bank with 203 branches abroad (including Milan), has increased its financial transactions in yuan between China and Russia, as it is linked to both the Chinese CIPS and Russian SPFS systems. In the past 10 months, the assets of ICBC’s Moscow branch have increased by over 200% and customer deposits by 290%. In addition, almost 48 financial institutions have opened an account with ICBC Moscow. A lifeline for sanctions-hit Russia, but also an important affirmation for China, which by the end of 2021 had separately signed bilateral currency settlement agreements with Vietnam, Indonesia and Cambodia, as well as currency exchange agreements with Indonesia, Malaysia, Singapore and Thailand, making it the fifth most traded currency in the world[94]. By the end of 2022, Russian families held nearly USD 6 billion in yuan at Russian banks[95].

How the West reacts

The Western political and financial system was surprised by the alliance between Russian and Chinese currencies[96]

In recent weeks, political officials from Germany, France and Great Britain have tried to convince the government in Kiev to start talks with Russia, while continuing to supply Ukraine with arms, food, fuel and medicine[97] and passing another package of sanctions against Russia[98]. Only now has the EU bothered to freeze the Russian Central Bank’s reserves (previously untouched by the sanctions): but the EU does not know how much the Central Bank’s assets amount to, where they are, and what form they take[99], so only $300 billion has been frozen[100], a figure insufficient to bring the Russian system to collapse, especially if it continues in parallel to be part of the global market and to profit from the generalised rise in commodity prices.

Zelensky expects to get the money from villas, yachts and accounts seized from Russian oligarchs to rebuild Ukraine, but Europe is wavering. This is because seized assets cannot be confiscated: to do so requires a judge’s conviction. The concept was reiterated at the first meeting of the European ‘Freeze and Seize’ task force: ‘So far we have managed to freeze EUR 21.5 billion in assets of oligarchs and entities on the sanctions list, and we will continue to work on different types of assets such as the reserves of the Russian Central Bank that it has been possible to freeze and on frozen transactions in various institutions“[101].

To begin with, the US has decided to go on the attack against Russian banks again. How? By widening the spectrum and sanctioning all those institutions guilty of still flirting with those of the former Soviet Union. In other words, any transaction with and to a Russian bank will be sufficient to justify a sanction, perhaps even exclusion from the SWIFT circuit. The aim is to cut off the legs of Russian finance, making scorched earth around its allies[102]. Europe is certainly not sitting on its hands. Brussels is trying to force Russian institutions to disclose information on the activities of the Russian Central Bank in order to obtain a complete audit and reconnaissance of the EU’s tied-up secured assets: ‘We need to know where they are and how much they are worth,’ said Ursula von der Leyen[103].

The payment cards issued by Russian banks under sanctions no longer work in Europe – cutting off entrepreneurs, families, ordinary citizens who are abroad and whose savings are only available with cards traceable to institutions in the Russian Federation. The blocking of cards could soon extend not only to banks in Russia, but also to all those institutions that are not necessarily domestic but do business with the Kremlin[104].

Recently, the West has imposed a series of price limits and a Europe-wide embargo on Russian oil products. Diesel is limited to $100 per barrel, fuel oil to $45. However, this mechanism could dry up markets faster than desired by Western officials, threatening sharp swings in global prices for these fuels. Last year, diesel prices in Europe rose to record highs amid concerns of potential shortages. However, they have plummeted recently after traders stockpiled[105]: Russia managed to divert some of its exports to Turkey, North Africa, and Latin America. Much of Russia’s oil trade now takes place through a shadow fleet outside the jurisdiction of the US and its allies[106].

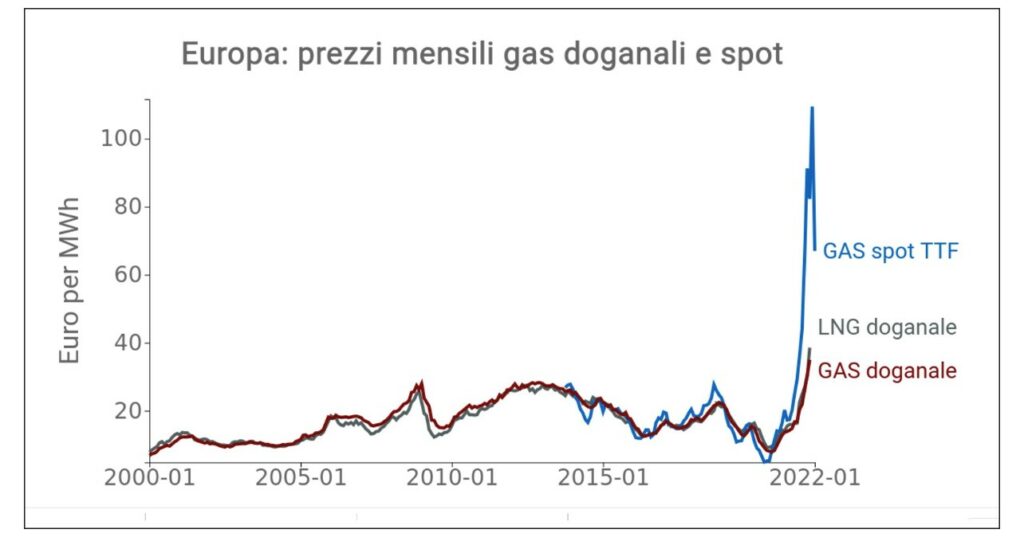

Global gas price development in 2022[107]

The interruption of energy imports from Russia has highlighted the need for the development of wind and solar energy. But these energy sources are more expensive and less stable than fossil fuels or nuclear power, even though they are seriously harmful to the environment. And since China controls a large part of the global supply chain of the minerals needed for the ‘green transition’, green energy merely replicates in Asia the form of energy dependence that Europe now complains about vis-à-vis Russia[108].

What has been described so far explains why economic sanctions alone are not enough to put pressure on Russia to withdraw from Ukraine. As many have suspected for some months now, the sanctions mainly affect the European Union, and risk undermining its compactness and democratic stability. One of the myriad reasons why it would be suicidal to leave Ukraine to its own devices is that this would accelerate the tendency, present in all Western democracies, to move to the right and start dreaming of a return to a medieval society, in which citizens do not have responsibility for their own lives, but delegate it, first by voting for theocracies and technocratic oligarchies, then absolutist regimes that hold control over systems of social manipulation.

What is to be done? From our infinitesimally small point of view, the first goal is to identify the names and networks of Goznak’s trustees scattered no longer in tax havens, but in nations that adhere to the system of financial control run by Russia or China – starting with Goznak’s representative offices in the world’s most forgotten places, only to realise that there are Western lawyers and brokers who, consciously or unconsciously, are working for the final demise of the democracies born of the Risorgimento and the struggle against the monarchical restoration of 1815.

RUS026

[1] PER PUTIN È L’ORA DEL REGOLAMENTO DEI CONTI | IBI World Italia ; ANCHE A MOSCA SI MUORE DI PUTIN | IBI World Italia ; QUANDO GLI OLIGARCHI PRENDONO IL LARGO | IBI World Italia

[2] https://www.bild.de/regional/muenchen/muenchen-aktuell/in-den-heiligen-hallen-des-geldes-kennen-sie-die-muenchen-mark-78955246.bild.html ; https://www.gi-de.com/en/careers/who-we-are/our-story

[3] https://www.coinbooks.org/esylum_v13n09a02.html

[4] Ludwig Devrient, Franziska Jungmann-Stadler, ”Giesecke & Devrient”, Böhlau Verlag, Köln 2014

[5] https://ru.rodovid.org/wk/%D0%97%D0%B0%D0%BF%D0%B8%D1%81%D1%8C:277525

[6] Official web-site: https://goznak.ru/

[7] Official web-site: https://rosim.gov.ru/

[8] Official Journal of the European Union, 6 October 2022: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2022:259I:FULL&from=EN , pag. 93

[9] https://frankrg.com/94704 ; https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-90668.html

[10] https://www.beehive.govt.nz/release/new-trade-bans-and-sanctions-oligarchs-and-russian-officials

[11] Official web-site: https://goznak.ru/about/today/branches/

[12] “Zimbabwe Can’t Paper Over Its Million-Percent Inflation Anymore; Under Pressure, German Company Cuts Off Shipments of Blank Bank Notes to Mugabe,” Wall Street Journal. July 2, 2008.

[13] https://archive.org/details/bub_gb_zIfPAAAAMAAJ/page/575/mode/2up

[14] https://www.dw.com/de/geld-f%C3%BCr-die-welt/a-1330650 ; https://www.moneypedia.de/index.php/Buch:_Giesecke_%26_Devrient_1852_-_2002

[15] https://nlr.ru/e-res/law_r/search.php?part=165®im=3

[16] https://goznak.ru/about/history/ ; https://museum.goznak.ru/about/goznak/

[17] https://goznak.ru/about/history/ ; https://museum.goznak.ru/about/goznak/ ; La cartamoneta in Russia. A.E. Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[18] https://timenote.info/ru/Boris-Borisovich-Golicin

[19] Spedizione per la preparazione dei titoli di Stato (EZGB) 1818-2008. FGUP Goznak. La storia in eventi, date, destini. – Мosca, 2008. – pag. 64.

[20] https://goznak.ru/about/history/ ; https://museum.goznak.ru/about/goznak/ ; La cartamoneta in Russia. A.E. Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 199: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[21] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[22] https://timenote.info/ru/Boris-Borisovich-Golicin

[23] https://www.simvolika.org/mars_048.htm

[24] https://goznak.ru/about/history/ ; https://museum.goznak.ru/about/goznak/

[25] https://web.archive.org/web/20120204035857/http://www.artonline.ru/encyclopedia/071

[26] Spedizione per la preparazione dei titoli di Stato (EZGB) 1818-2008. FGUP Goznak. La storia in eventi, date, destini. Мosca, 2008. pag. 93

[27] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[28] https://gwar.mil.ru/informations/encyclop/oktyabrskaya-revolyutsiya-1917-goda/ ; https://www.prlib.ru/history/619694

[29] http://www.stiftung-teubner-leipzig.de/1986-rundgang-b500.jpg

[30] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[31] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[32] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[33] La cartamoneta in Russia. A.E.Michaelis, L.A.Kharlamov, Stabilimento tipografico Goznak di Perm. 1993 г., see more: http://www.bonistikaweb.ru/KNIGI/mihaelis.htm

[34] https://web.archive.org/web/20161229101206/http://www.rg.ru/2005/08/31/goznak-dok.html

[35] http://www.kremlin.ru/acts/bank/21246/page/1

[36] https://goznak.ru/about/history/ ; https://museum.goznak.ru/about/goznak/

[37] https://whoiswho.dp.ru/cart/person/878607

[38] https://100biografiy.ru/biznes/arkadij-trachuk

[39] http://www.fa.ru/org/dep/men/News/2017-02-10-rukovoditel-departamenta-menedzhmenta-arkadiy-trachuk-nagrazhden-ordenom-druzhby.aspx

[40] https://sdelanounas.ru/blogs/39159/

[41] https://www.sostav.ru/publication/angola-zakazala-goznaku-novyj-dizajn-banknot-4957.html

[42] Regione Carabinieri Campania, Stazione di Vico Equense, “Informativa di reato relativa all’operazione Cheque to Cheque” (1998.06.30 Final General Report (1-200))

[43] https://academic.oup.com/book/41882/chapter-abstract/354711127?redirectedFrom=fulltext ; https://www.glistatigenerali.com/medio-oriente_russia/haftar-la-spia-che-venne-dal-freddo/

[44] https://www.sostav.ru/publication/angola-zakazala-goznaku-novyj-dizajn-banknot-4957.html ; https://sdelanounas.ru/blogs/39159/

[45] https://citizenshiprightsafrica.org/angola-is-africas-richest-woman-a-russian-citizen/ ; https://www.themoscowtimes.com/2020/02/12/she-will-flee-to-russia-portugal-freezes-richest-african-womans-accounts-a69252

[46] https://web.archive.org/web/20170615210351/http://goznak.ru/about/press/news/12679/

[47] https://web.archive.org/web/20170705154411/http://goznak.ru/about/press/news/16095/

[48] https://web.archive.org/web/20170615210351/http://goznak.ru/about/press/news/12679/

[49] https://ibiworld.eu/2023/02/23/lavrov-lafrica-e-il-nuovo-ordine-globale/

[50] https://ria.ru/20230223/afrika-1853930437.html?utm_medium=40digest.intl.20230227.home&utm_source=email&utm_content=&utm_campaign=campaign

[51] https://www.mk.ru/incident/2020/06/17/v-yemene-boeviki-ukrali-milliony-napechatannye-rossiyskim-goznakom.html

[52] https://ria.ru/20200617/1573079232.html

[53] https://www.openpr.com/news/2918520/should-you-be-excited-about-e-passport-market-25-9-cagr-nxp

[54] http://yemen-club.ru/index.php?id=84 ; http://ricolor.org/history/eng/vs/24_12_2015/

[55] https://russiancouncil.ru/blogs/ltsukanov/rossiya-i-yemen-zerkalo-strategicheskikh-interesov/

[56] https://russiancouncil.ru/blogs/ltsukanov/rossiya-i-yemen-zerkalo-strategicheskikh-interesov/

[57] https://aif.ru/money/economy/glava_goznaka_arkadiy_trachuk_bumazhnye_dengi_eshchyo_dolgo_budut_vostrebovany

[58] https://www.rusprofile.ru/person/trachuk-av-781105525180

[59] https://aif.ru/money/economy/kakim_stranam_goznak_pechataet_monety ; https://aif.ru/money/economy/dlya_kakih_stran_rossiya_pechataet_dengi

[60] https://aif.ru/money/company/dlya_kogo_goznak_delaet_dengi#id=5678593

[61] https://aif.ru/money/economy/glava_goznaka_arkadiy_trachuk_bumazhnye_dengi_eshchyo_dolgo_budut_vostrebovany

[62] https://ibiworld.eu/2023/01/26/haftar-la-spia-che-venne-dal-freddo/

[63] https://www.dw.com/ru/%D0%BA%D0%BE%D0%BC%D0%BC%D0%B5%D0%BD%D1%82%D0%B0%D1%80%D0%B8%D0%B9-%D0%BF%D1%83%D1%82%D0%B8%D0%BD-%D0%BD%D0%B5-%D1%81%D0%B4%D0%B0%D1%81%D1%82-%D1%85%D0%B0%D1%84%D1%82%D0%B0%D1%80%D0%B0/a-53648756

[64] https://www.glistatigenerali.com/medio-oriente_russia/haftar-la-spia-che-venne-dal-freddo/

[65] https://aif.ru/money/economy/glava_goznaka_arkadiy_trachuk_bumazhnye_dengi_eshchyo_dolgo_budut_vostrebovany

[66] https://www.rbc.ru/politics/18/01/2023/63c7f79e9a79473a8c2a9c22

[67] https://www.rbc.ru/finances/02/03/2022/621f595b9a79477da51d9db3

[68] https://fincult.info/article/chto-takoe-swift-i-chem-grozit-otklyuchenie-rossiyskikh-bankov-ot-etoy-sistemy/

[69] https://www.snb.ch/it/iabout/internat/multilateral/id/internat_multilateral_bis ; https://www.bis.org/

[70] https://www.uek.ch/it/publikationen1997-2000/goldi.pdf

[71] Gian Trepp, „Bankgeschäfte mit dem Feind“, Rotpunktverlag, Zürich 1997

[72] https://www.forbes.ru/finansy/460331-vtoraa-rascetno-kliringovaa-sistema-zablokirovala-scet-rossijskogo-depozitaria

[73] https://www.raexpert.ru/press/articles/rbc_tabah6/

[74] https://journal.tinkoff.ru/news/ncc-and-sanctions/

[75] https://quote.rbc.ru/news/article/63d8c5db9a79475d8f7a1497

[76] https://aif.ru/money/company/dlya_kogo_goznak_delaet_dengi#id=5678593

[77] https://www.rbc.ru/finances/08/02/2023/63e36b3a9a7947967bdd2b47

[78] https://www.rbc.ru/finances/16/08/2022/62fa57ed9a7947f2d14f2e15

[79] https://quote.rbc.ru/news/article/63a5c9b19a794770ab8bb3ae

[80] https://www.rbc.ru/finances/08/02/2023/63e36b3a9a7947967bdd2b47

[81] https://quote.rbc.ru/news/article/63ef7c189a794777f4e4367b

[82] https://www.rbc.ru/economics/12/01/2023/63bfe86c9a7947fbc76263cd

[83] https://quote.rbc.ru/news/article/6352b95b9a7947fc6625d2c3

[84] https://reliefweb.int/report/iraq/iraq-oil-food-programme-independent-inquiry-committee-finds-mismanagement-and-failure

[85] https://cbr.ru/PSystem/fin_msg_transfer_system/#:~:text=%D0%A1%D0%B8%D1%81%D1%82%D0%B5%D0%BC%D0%B0%20%D0%BF%D0%B5%D1%80%D0%B5%D0%B4%D0%B0%D1%87%D0%B8%20%D1%84%D0%B8%D0%BD%D0%B0%D0%BD%D1%81%D0%BE%D0%B2%D1%8B%D1%85%20%D1%81%D0%BE%D0%BE%D0%B1%D1%89%D0%B5%D0%BD%D0%B8%D0%B9%20%D0%91%D0%B0%D0%BD%D0%BA%D0%B0,%D1%82%D0%B0%D0%BA%20%D0%B8%20%D0%B7%D0%B0%20%D0%B5%D0%B5%20%D0%BF%D1%80%D0%B5%D0%B4%D0%B5%D0%BB%D0%B0%D0%BC%D0%B8.

[86] https://timesofindia.indiatimes.com/business/india-business/learning-with-the-times-swift-exclusion-to-affect-russias-trade/articleshow/89878346.cms

[87] https://fincult.info/article/chto-takoe-swift-i-chem-grozit-otklyuchenie-rossiyskikh-bankov-ot-etoy-sistemy/

[88] https://fincult.info/news/moshenniki-nachali-zapugivat-lyudey-neponyatnym-slovom-swift/

[89] https://www.rbc.ru/rbcfreenews/63d7c5c79a79471816776eba

[90] https://www.rbc.ru/finances/06/09/2022/6315d47c9a79473c9ed47859

[91] https://www.banki.ru/news/lenta/?id=10969186 ; https://www.rosswift.ru/news/900

[92] https://www.geopolitica.info/esclusione-russia-swift-internazionalizzazione-renminbi/

[93] https://www.milanofinanza.it/news/la-russia-isolata-comincia-ad-affidarsi-allo-yuan-al-posto-del-dollaro-202302281740235391

[94] https://www.geopolitica.info/esclusione-russia-swift-internazionalizzazione-renminbi/

[95] https://www.milanofinanza.it/news/la-russia-isolata-comincia-ad-affidarsi-allo-yuan-al-posto-del-dollaro-202302281740235391

[96] https://www.reuters.com/markets/currencies/russias-central-bank-sold-47-mln-worth-chinese-yuan-jan-13-2023-01-17/

[97] https://www.milanofinanza.it/news/macron-e-scholz-provano-a-convincere-zelensky-a-pensare-alla-pace-con-la-russia-202302242006351696

[98] https://tg24.sky.it/mondo/2023/02/26/ue-decimo-pacchetto-sanzioni-russia

[99] https://www.adnkronos.com/sanzioni-russia-le-riserve-della-banca-centrale-sono-un-buco-nero_1oAslH9LRVwHJwra8foTCt?refresh_ce

[100] https://formiche.net/2023/02/russia-banche-europa-usa/

[101] https://europa.today.it/attualita/beni-sequestrati-russia-ricostruire-ucraina-ue-delude-kiev.html

[102] https://formiche.net/2023/02/russia-banche-europa-usa/

[103] https://formiche.net/2023/02/russia-banche-europa-usa/

[104] https://formiche.net/2023/02/russia-sanzioni-banche-carte-ucraina/

[105] https://www.milanofinanza.it/news/cosi-la-russia-continua-a-vendere-il-suo-petrolio-proprio-come-vuole-l-occidente-202302231833396341

[106] https://www.milanofinanza.it/news/cosi-la-russia-continua-a-vendere-il-suo-petrolio-proprio-come-vuole-l-occidente-202302231833396341

[107] https://www.fondazionehume.it/economia/le-speculazioni-sul-gas-che-stanno-creando-il-caro-bollette-e-le-authority-stanno-a-guardare/

[108] https://www.milanofinanza.it/news/la-lezione-della-guerra-in-ucraina-che-l-europa-non-vuole-imparare-202302241818265756

Leave a Reply