ZHONGZHI AND THE DEEP CRISIS OF THE CHINESE ECONOMY

Mass migrations due to wars (Ukraine and Israel above all), climate change and a new rise of radical Islam are at the top of Westerners’ immediate fears. In the medium term, however, the growth of China and the other powers of the ‘Global South’, among which the BRICS group (Brazil, Russia, India, China, South Africa) stands out, seems to destine the Euro-US bloc to an increasingly marginal role on the world economic scene[1] .

At the Johannesburg summit in August 2023, BRICS decided to expand its membership: as of January 2024, Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates are also part of the group[2] . At the moment, the BRICS members include six of the ten largest oil producers on the planet, and there is a possibility that, within a decade, this group will succeed in reforming the major international financial institutions, including the World Bank and the International Monetary Fund[3] . This rear-guard perspective of the West is, for the time being, living in a quagmire of stagnation and risk of recession[4] . Yet the prolonged crisis engulfing China, which threatens to radically change the shape of the global economy, should worry us. Because, beyond future prospects, our future and that of the Asian giant are intertwined.

Zhongzhi, the colossal Beijing-based shadow banking group, declared its insolvency in November 2023[5] . In order to understand the magnitude of the event and trace the history of the group in its links to the Chinese economy, it is necessary to briefly clarify what shadow banks are and why they have flourished over the last fifteen years, linking their fate to that of the country’s cyclopean real estate companies: a Nonbanking financial institution (NBFI) is a financial institution that does not have a full banking licence and cannot accept deposits from the public[6] .

The shadow banking system is thus unregulated and not subject to the strict regulations in terms of liquidity and capital restrictions that guide the actions of traditional banks; this brings advantages and, inevitably, risks. These institutions perform similar functions to banks: being outside the formal banking sector, however, they lack a solid safety net, be it deposit insurance or central bank bailout instruments.

A shadow bank (NBFI) is more agile and can lend much faster than a real bank, without needing the same collateral; shadow banks can therefore help stimulate economic growth through cheap and easily available financial services, at the price of reduced financial stability. The lower safety margins of shadow banks result from the low level of regulation they are subject to and the fact that they are not required to have as much equity capital as official banks[7] .

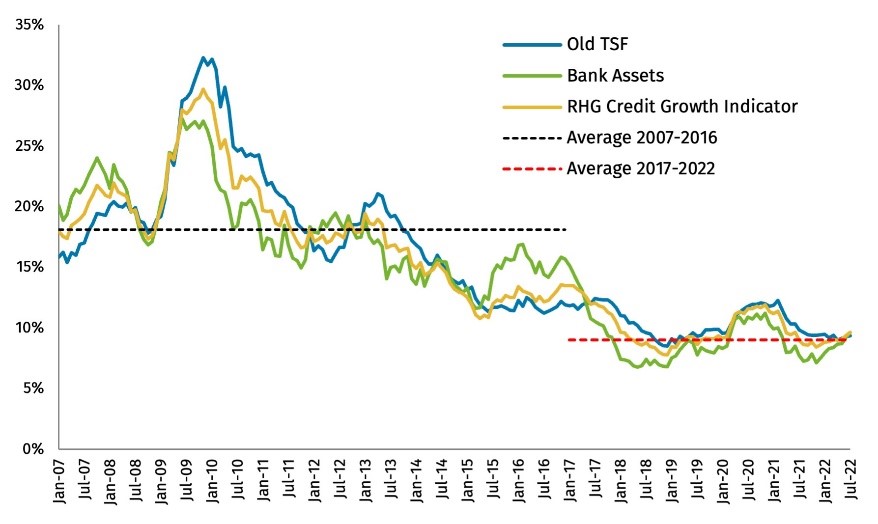

It is precisely price competitiveness and the ease of obtaining liquidity that are the main reasons for the exponential growth in the business volume of shadow banks, especially after the 2008 financial crisis, following which banking institutions around the world have made access to credit significantly more difficult for individuals and companies[8] ; China, where large state-owned banks dominated the market until the last decade, is no exception. The government imposes limits on the volume of investments on its institutions, regulators discourage lending to certain sectors and impose a limit of 75% of bank loans to deposits[9] .

The diagram of China’s economic collapse[10]

Already in 2016, the year in which an initial form of government crackdown on the shadow credit system began, experts in the field raised worried questions about the uncontrolled expansion of the phenomenon and the substantial deregulation in which Beijing is allowing it to take on uncontrollable proportions; thus more and more companies, corrupt officials wishing to move money abroad, local governments eager to make a profit from the high rates of return, but also and above all the middle class, are turning to the financial products offered by shadow banks.

However, the country’s leadership is also responsible for not offering the population attractive alternatives: the stock market is subject to periodic collapses, which have burnt the savings of many investors; the real estate sector (as we described more than a year ago[11] ) experiences extreme fluctuations (before 2020, it had already collapsed in China in 2015), also requiring large amounts of capital to get started; the products of the official banks offer low returns. Investing with substantial prospects in terms of return (but also risk) leads straight to shadow banks[12] .

According to the ‘Report on China’s Shadow Banking System’ published in 2020 by the China Banking and Insurance Regulatory Commission, the shadow banking sector as a whole (including asset management products and consumer loans) is worth USD 12 trillion in 2019[13] ; China’s GDP that year is just over USD 14 trillion[14] . In particular, the 68 licensed trust firms hold, in 2022, 22 trillion yuan ($3 trillion)[15] . For comparison, the GDP of the entire European Union is 17 trillion[16] .

Over the past fifteen years, trusts have grown about eightfold, making them one of the most thriving sectors in China’s shadow banking universe; they collect customers’ savings and use them to lend to property speculators, thereby also replenishing languishing local government coffers through tax revenues on new construction. The money can be raised by turning the loan into an investment product to be sold to domestic corporations or wealthy individuals, who are implicitly promised a hefty return on the investment[17] .

This is the case of CITIC Trust, the investment arm of the state-owned financial conglomerate CITIC Group (China International Trust and Investment Company) (Beijing)[18] , which aimed to raise USD 1.7 billion in 2020 to finance four real estate mega-projects of Sunac China Holdings Ltd. For this purpose, the CITIC Trust created the Junkun Equity Fund, an investment fund from which investors were expected to earn a double-digit percentage return, given the soaring prices in the real estate market.

Growth of the shadow banking system in China[19]

The EUR 1.7 billion was raised and lent to Sunac, then came Covid: the realisation of the properties suffered major delays and building sales were severely affected. Moreover, in 2020, the Chinese government enacted new regulations against over-indebtedness of real estate developers such as Sunac, creating further difficulties in repaying the loan: one real estate project was halted, others are proceeding at a hiccup, and investors have received back a small part of what they invested. CITIC Trust is in dire straits, while Sunac is in default, struggling with a debt restructuring plan[20] .

The cyclopean crisis afflicting the Chinese real estate market also has consequences for those players involved that are administered by the Chinese state: the developer China South City Holdings Shenzen, for example, announced in December 2023 that it could not pay November interest to investors, who agreed to a debt restructuring to avoid bankruptcy of the group[21] .

The financial giant Zhongzhi Enterprise Group (ZEG) and its trust arm, Zhongrong International Trust (ZIT), manage USD 140 billion in assets. Zhongzhi is a private conglomerate involved in venture capital (high risk financing[22] ), asset management and insurance. In the mining sector, Zhongzhi has 4.5 billion tonnes of coal reserves, owns more than 30 mining and exploration rights, and has a planned production capacity of more than 20 million tonnes/year.

The group also owns mines in 12 provinces of the country, from which gold, silver, copper, iron, tungsten, manganese and lithium are extracted, as well as sand and gravel aggregates[23] . In addition to the one in Zhongrong, Zhongzhi participates in five other institutions for operations in the financial branch: Zhongrong Fund, Hengqin Life Insurance Co., Ltd. Guangdong, Hengbang Property Insurance Co. Ltd. Shangrao, Zhongrong Huixin Futures Co., Ltd. Hangzou and Tianke Holding Group, Ltd. Hong Kong. ZEG controls or holds shares in four asset management companies (Zhonghai Shengrong, Zhongzhi International, Zhongzhi Capital (Beijing) (a subsidiary of Zhonghai Shengrong), and Shoutuo Rongsheng Investment Co., Ltd.) and four wealth management companies (Hang Tang Wealth Investment Management Co, Ltd. (one of Hang Tang’s main shareholders is, as for Zhongrong International Trust, the state-owned company Jingwei Textile Machinery[24] ), Xinhu Wealth Investment Management[25] , Datang Wealth management Co. Ltd., which sells products of Zhongrong International Trust[26] , and Gaosheng Wealth[27] .

Founded in 1995 as the Helongjiang Zhongzhi Enterprise Group Company (founder Xie Zhikun died on 19 December 2021 at the age of 61[28] ), the company soon entered the field of papermaking materials and real estate development; it acquired its current name of Zhongzhi Enterprise Group Co, Ltd. (ZEG) in 1999, in 2001 it opened up to financial services, expanding in the direction of the fiduciary sector, operating over time a series of acquisitions and mergers that were decisive in positioning the group at the top of investment groups, opening branches in Europe, the USA and Singapore over the past decade, and coming to control nine listed companies[29] . At its peak, ZEG’s asset management arm would have managed over USD 139 billion[30] .

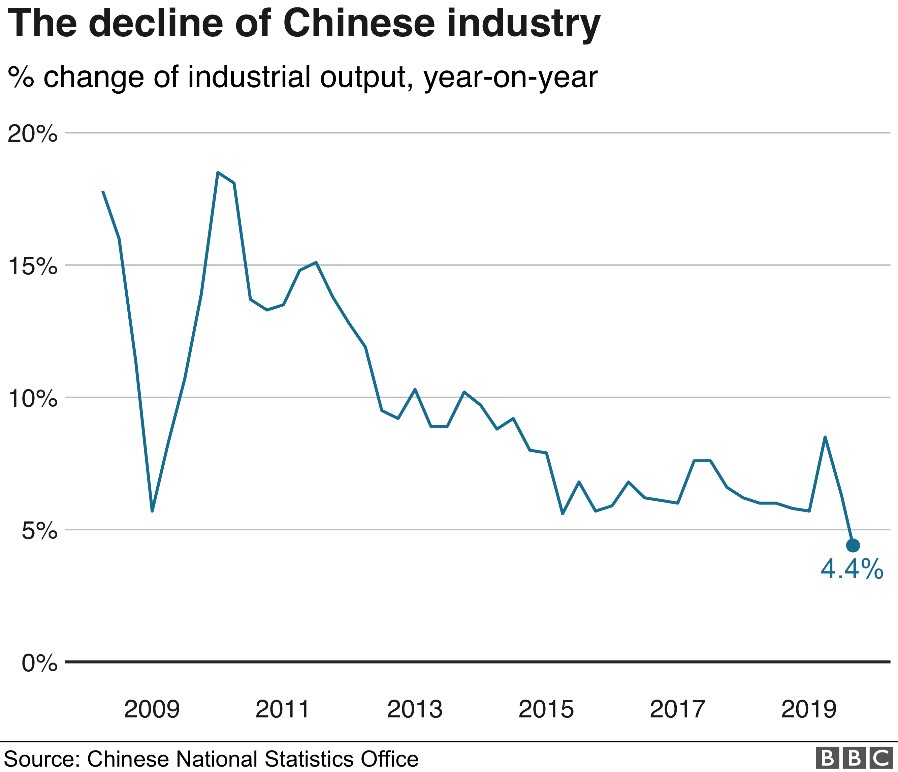

The crisis of Chinese industry[31]

ZEG holds 33% of Zhongrong, which had $86 billion in investments in 2022[32] . For investors, Zhongrong’s products were perceived as safer than others because the Trust’s majority shareholder (37.5%) is Jingwei Textile Machinery[33] , while a minority shareholder is Datang International Power Generation[34] , a utility: both Jingwei and Datang are state-owned companies. The Zhongrong International Trust was founded in 1987 under the name Harbin International Trust Investment Co. Ltd.; after Jingwei and Zhongzhi, the third largest shareholder of Zhongrong today is Harbin Investment Group Company Limited[35] , which holds 21.54% of the shares[36] . Last August, Jingwei announced the withdrawal of its shares from the market[37] , after Zhongrong started to default on payments on dozens of investment products from June 2023[38] .

The group, which at the end of 2019 declares assets of USD 120 billion[39] , in the last days of November 2023 becomes the subject of investigations by the Beijing Public Security Bureau for suspected criminal activities[40] ; ZEG declares liabilities of USD 64 billion at that time, due to a significant exposure in the real estate sector[41] , against assets of USD 28 billion[42] . As early as August, at the first hint of a major problem, a demonstration was staged in front of the Beijing giant’s headquarters by many betrayed investors[43] .

Following the start of the investigation, two executives of the Zhongzhi Enterprise Group disappeared: 59-year-old Ma Changshui, president of Xinjiang Tianshan Animal Husbandry Bio-Engineering and vice-president of Zhongzhi, and Ma Hongying, 38, president of Dalian My Gym Education Technology as well as a board member and, in the past, also financial director of Zhongzhi. Both Changsui’s and Hongying’s companies are listed on the Shenzhen stock exchange and the majority stake is held by the Zhongzhi group. The likelihood is high that the two were arrested[44] , as was the founder’s grandson, whose name has not been disclosed[45] .

The Chinese media also report that other members of Xie Zhikun’s family and senior executives of the group would have cashed in their investment returns before the group’s difficulties were made public[46] . Although the lack of transparency is one of the peculiar characteristics of shadow banking, it is possible to estimate that Zhongrong has invested around 11% of its capital in real estate (42% is employed in industry and 33% in financial institutions[47] ), the highest percentage among large Chinese trusts; among the companies in the sector responsible for the shadow banking crisis is Sunac, one of China’s largest real estate developers, against which Zhongrong itself has filed lawsuits for over USD 1.2 billion. Sunac, after defaulting in 2022, embarked on a debt restructuring plan in March 2023[48] .

Textile chemical company Zejiang Jihua reveals (April 2023) that Zhongrong delayed payments on two products in March 2021 and April 2022: these products are said to be linked to real estate projects developed by Sunac and China Fortune Land Development (CFLD)[49] : in December 2020, the trust lends 1.5 billion yuan (in the form of a perpetual bond) to CFLD, which two months later goes into default[50] . Yango Group co. Ltd. Shanghai[51] , another real estate developer, receives a loan of an unknown amount before also going into default in 2022 (Yango claims to have repaid Zhongrong 3.3 billion yuan after selling the real estate project for which it had received financing) . [52]

Two Zhongzhi executives have mysteriously disappeared [53]

Also on the list of real estate developers Zhongrong has had to deal with is Evergrande Real Estate Group (Cayman Islands), the world’s most indebted real estate group[54] : the trust is suing it (along with other developers) in May 2022 for a 1.9 billion yuan loan; Evergrande has faced more than 2,000 lawsuits, with a total insolvency value of 535 billion yuan[55] . Local governments are also contributing to Zhongrong’s difficulties: a state investment fund of the city of Xi’an declared in July 2023 that it had delayed the repayment of a 900 million yuan loan to Zhongrong[56] .

Since mid-2023, rumours of a possible bankruptcy for Zhongzhi Enterprise Group have been chasing each other, which is declared in January 2024. The real estate development companies to which Zhongrong, and thus Zhongzhi, has been inseparably linked in the past years have not withstood the terrible ordeal that began in 2020 with the incursion of the COVID-19 pandemic onto the world stage; the resulting chain of defaults in the sector inexorably dooms the shadow banking sector[57] . Although the majority of creditors are wealthy individuals and not financial institutions, episodes such as Zhongzhi’s would seriously undermine investor confidence, which would negatively impact future opportunities for real estate developers to access financing from the trust sector.

Senior credit analyst Zerlina Zeng (CrediySights) does not expect salvific intervention by the government because of the form of many wealth management products offered by the Zhongzhi Group, which have long been discouraged or banned by Chinese regulators. Some of these products are comparable to a Ponzi scheme[58] . The current crisis could lead other trust groups to default in the wake of the real estate investors whose fates they have tied to and, secondarily, debt-ridden local governments, which are likely to continue to prioritise government debt at the expense of trust loans[59] .

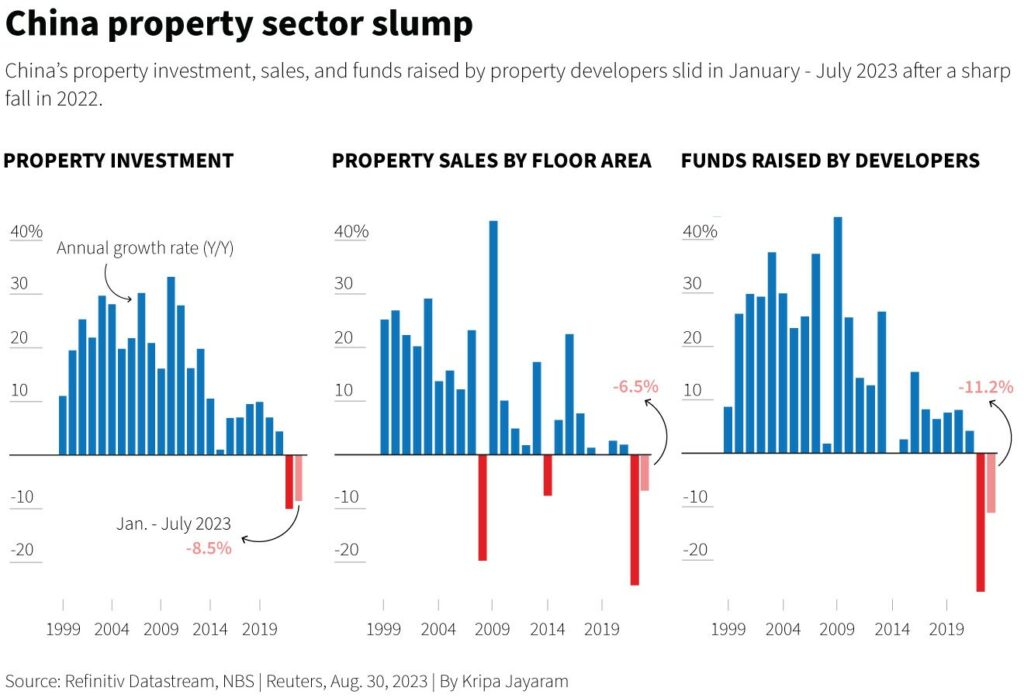

One obstacle to solving the problem is the situation of real estate under construction: according to Hao Hong, chief economist of the Grow Investment Group, it will take ten years to dispose of all the real estate in the pipeline today; growth in sales and property prices is slow due to the debt crisis that has affected real estate developers since 2020[60] , when the Chinese government severely limited their debt capacity through the ‘three red lines’ policy, specific balance sheet conditions that companies must meet in order to access more credit: they must limit their debt in relation to 1) cash flow; 2) assets; 3) company capital levels[61] .

These measures come in the wake of the overflowing growth of the sector, which leads to the construction of veritable ghost towns. The problem of the disproportion between supply and demand stems from the fact that developers such as Country Garden – which went into default in October 2023, shortly after Evergrande[62] – concentrate their activity (61% of the total) in the less developed areas of China, in sub-standard cities, which offer low attractiveness potential for prospective buyers.

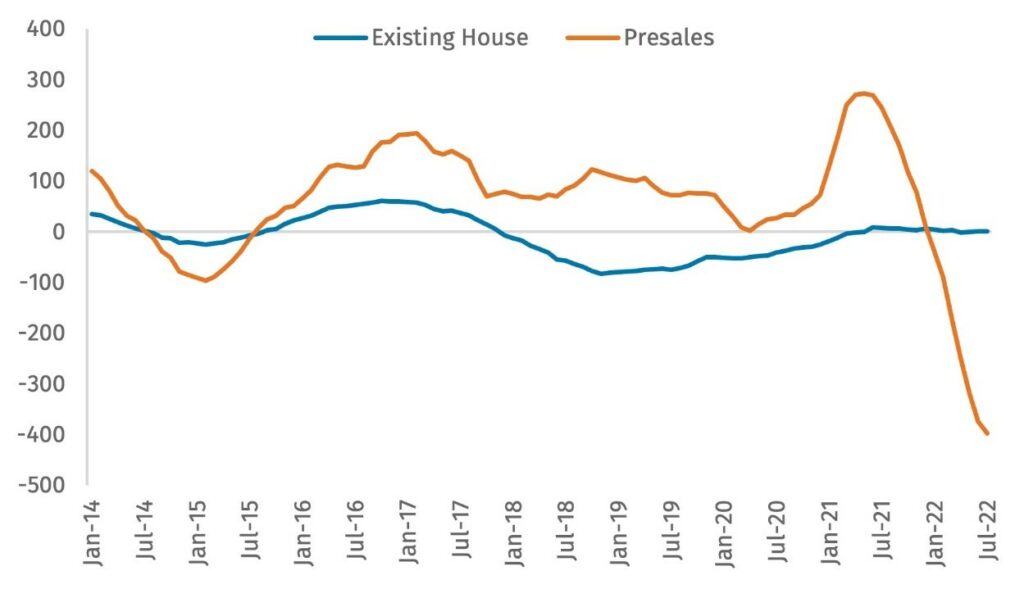

In the middle months of 2023, Country Garden sales dropped by 50 per cent; after peaking in 2021, sales in the real estate sector slowed unstoppably due to Covid but also due to delivery delays, which caused buyers to stop taking out mortgages[63] . Many of these are buying houses when they only exist on paper: due to the huge delays in construction in recent times, many developers have yet to deliver houses for which they received payments between 2015 and 2020[64] .

Some of the Evergrande Group’s idle and abandoned construction sites[65]

Against this backdrop, state-owned developers, which grew by 48% between January and July 2023, bought 87% of the building land in the second half of the year, further dampening the recovery of private enterprises[66] . In December 2023, the Chinese government pledged to implement a nine-point programme to revive the economy and attempt to kick-start the recovery during 2024, through measures to boost domestic demand and counter the real estate crisis; on this last point, Beijing aims to reduce average house prices, so as to encourage a recovery in purchases that will break the downward spiral enveloping businesses and the shadow trust sector[67] .

The government would also like to reduce the real estate sector’s impact on China’s economy, which currently stands at one third[68] , although the decrease in the number of land sales would put local governments in further difficulty[69] . In this climate of substantial uncertainty, Moody’s agency lowered its outlook on China’s government credit rating from stable to negative, expecting a decline in China’s fiscal, economic and institutional strength due to Beijing’s efforts to implement fiscal stimulus plans to bail out local governments and stop the debt crisis[70] .

In October 2023, the government states that it has launched a measure to allow local governments to borrow funds for 2024, quantified according to the determinations of the State Council, under a framework that will last until the end of 2027[71] . The Chinese authorities also announced the issuance of 1 trillion yuan (USD 137 billion) in government bonds to be allocated to local governments for recovery and reconstruction needs after the natural disasters that devastated the country during the year, increasing the fiscal deficit from 3 to 3.8%[72] .

The International Monetary Fund cuts its forecasts on Chinese growth for both 2023 (from 5.2% to 5%) and 2024 (from 4.5% to 4.2%). The IMF’s misgivings about China’s recovery relate to Beijing’s ability to move from a model based on investment in the real estate sector, no longer viable as a driving force in the light of recent disasters, to one capable of stimulating consumption and, therefore, recovery. The crisis in the real estate and shadow banking sector has severely undermined consumer confidence. The Chinese are not spending and wealth remains, at the moment, in the real estate sector, despite the government’s attempts to rebalance the situation.

Consumption is expected to stabilise at a lower level than pre-pandemic, mainly because people are known to spend less on durable goods if the general climate is one of high uncertainty[73] : when there is a structural crisis and the economic system is ageing, consumption falls along with expectations. Since August 2023, China has thus experienced, for the first time in the last two years, a period of deflation[74] , a generalised fall in prices that is highly damaging to the economy, because it could induce individuals and companies to postpone purchases in anticipation of a further fall, further slowing down the economy in a vicious circle that is not easy to reverse.

Overall performance of the Chinese economy[75]

In addition to the weakness of domestic demand, food prices, which fell by 4.2% in November 2023 compared to the same month of the previous year, also contributed to a large extent to deflation; to a lesser extent, fuels and services (which rose by only 1%); the producer price index (PPI) – which is largely formed from the cost of raw materials – has been falling for fourteen consecutive months, dropping by 3% in November 2023[76] . In addition to Chinese culpability, it should be noted that the slowdown in the US and European economies has caused a decrease in the volume of exports to those markets; both the US and the Old Continent also strongly discourage the purchase of Chinese goods, which has slowed down: the tendency of the two players to disengage from the Chinese economy pushes US companies[77] and European companies[78] to increasingly source outside of China[79] .

While the slowdown of the Chinese economy is certainly a global problem, China is expected to emerge from the crisis better than the United States, Spain or Ireland did in the first fifteen years of the 21st century, by virtue of a stronger power of intervention on the part of politics, the role to be played by powerful state-owned credit institutions, and even tighter mortgage terms[80] .

A look at the trend of China’s Gross Domestic Product over the years shows how, from the growth peak of 14.2% recorded in 2007, it went down to 9.7% in the following year and then, after an upturn in 2010, GDP progressively dropped to 2.2% in 2020 (a negative record since 1976, when the value was -1.6%); 2021 saw the growth rate jump to 8.3%, falling back to 3% in 2022[81] .

The development model inaugurated in 1979 by opening up to trade and foreign investment in the context of free-market reforms has led China to the fastest and most sustained economic growth in history, enabling the country to double its GDP every eight years and become one of the largest trading partners of the United States[82] , as well as one of the largest foreign holders of US Treasury bonds[83] . China historically maintains a high savings rate[84] .

When the reforms started in 1979, domestic savings as a percentage of GDP was 36%. Most of the savings in this period were generated by SOE profits, which the central government used for domestic investment. Economic reforms, including the decentralisation of production, led to substantial growth in the savings of Chinese households and enterprises. As a result, China’s gross savings as a percentage of GDP is the highest among the major economies and one of the first ever[85] : in 2010, two years after the Great Financial Crisis, it peaked at 51%; in 2022, after the onset of the real estate crisis and the pandemic, the percentage is around 46%, up from the previous two years . [86]

Chinese property market trends over the past 25 years[87]

The high level of domestic savings has enabled China to sustain a high level of investment. In fact, China’s gross domestic savings levels, which have made the country a major global net financier, far exceed domestic investment levels[88] . The ability to increase productive efficiency has been another key factor in such rapid growth, through the redistribution of resources towards technological development in sectors heavily controlled by the central government, such as agriculture, trade and services. The decentralisation of the economy favoured the emergence of private enterprises capable of setting new standards in efficiency and market orientation, even exposing themselves to foreign competition.

With the ‘maturing’ of the Chinese economy and in the wake of the 2008 and 2020 crises that have not yet ended, the government is trying, as already written, to steer the economy in the direction of strengthening domestic consumption. One problem Beijing has to face in order to overcome this transition phase, which is typical of developing economies, is the ‘Middle Income Trap’. In the transition from effective growth strategies for low income levels to effective strategies for high income levels, countries (and their economies) can remain in a dangerous limbo, the middle income limbo,[89] ; after average wage levels are reached and the pace of growth slows down, it is difficult for middle-income countries to remain competitive, in terms of productivity, with rapidly expanding low-income countries.

This phenomenon, which the World Bank describes as the absence of a growth theory capable of informing the development policy of middle-income economies, concerns the five large economies of Latin America (Argentina, Brazil, Chile, Colombia and Mexico), which grew rapidly from the 1950s to the 1970s and then stagnated, but also the Philippines, Malaysia and Thailand, which at the beginning of the 21st century, having become middle-income countries, were overtaken in competitiveness by the then low-income China in the labour-intensive manufacturing sector[90] .

The World Bank ranks the development levels of economies using a method based on the analysis and comparison of gross income levels per capita[91] . According to this model, China went from being a low-middle-income economy to an upper-middle-income economy in 2010. The World Bank sets the minimum level to define the economy of a high-income country at USD 13’846 per capita. Some values for the year 2022: US: 76’770, UK: 49’240, Germany: 54’030, France: 45’290, Italy: 38’200. China is at 12’850[92] .

It is no longer enough to have been the engine of global economic growth since around 2010: in recent years, over-investment, possible thanks to high national savings, has ended up in less productive state-owned enterprises, including those in the real estate sector, which are less supportive of long-term growth, increasing China’s already large public capital; this has accelerated the overall decline in productivity and, thus, growth prospects[93] .

It is essential for economies throughout the rich world that China find convincing answers to the growth stalemate it finds itself in: several times in the past, the most industrialised countries have been able to sell Chinese consumers and companies cars, machinery, fuel and chemicals when their domestic consumption was falling. The Asian giant also supplied low-cost products for years, relying on the rapid growth of the working population to keep production costs low[94] . This time is over and today’s China is not in a position to save Europe[95] and the United States[96] , which are closely watching the spectre of recession.

JPN030

[1] https://www.cnbc.com/2024/02/13/china-and-russia-no-longer-perceived-as-top-security-threats-research-finds.html

[2] https://www.ispionline.it/en/publication/global-south-the-rest-vs-the-west-157988#:~:text=The%20role%20of%20specific%20groupings,to%20increase%20their%20global%20influence.

[3] https://www.stimson.org/2023/the-future-of-brics-between-objectives-and-challenges/

[4] https://illuminem.com/illuminemvoices/no-end-to-the-wests-economic-stagnation-as-the-climate-crisis-worsens ; https://www.gisreportsonline.com/r/recession/

[5] https://proytecpanamablog.wordpress.com/2024/01/09/chinese-irregular-zhongzhi-bank-fails/

[6] https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

[7] D. Elliott, A. Kroeber, Y. Qiao, ‘Shadow Banking in China. A primer’, Economic Studies at Brookings, March 2015

[8] https://www.helenbrowngroup.com/shadow-banks/

[9] D. Elliott, A. Kroeber, Y. Qiao, ‘Shadow Banking in China. A primer’, Economic Studies at Brookings, March 2015

[10] https://www.csis.org/analysis/chinas-slow-motion-financial-crisis-unfolding-expected

[11] INDEBTEDNESS IN CHINESE TRANSLATES AS EVERGRANDE – The Global Pitch

[12] https://www.bbc.com/news/business-37114643

[13] https://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=947343&itemId=934&generaltype=0

[14] https://tradingeconomics.com/china/gdp#:~:text=GDP%20in%20China%20averaged%203080.29,47.21%20USD%20Billion%20in%201962.

[15] https://asia.nikkei.com/Spotlight/Caixin/Chinese-trust-companies-are-dumping-risky-assets-5-things-to-know

[16] https://www.rgs.mef.gov.it/VERSIONE-I/e_government/amministrazioni_pubbliche/igrue/PilloleInformative/economia_e_finanza/index.html?Prov=PILLOLE

[17] https://www.nytimes.com/2023/12/28/business/citic-trust-china-property.html

[18] https://www.group.citic/en/Diversified_Portfolio/Finance/Trust/

[19] https://www.wsj.com/articles/chinese-trust-company-aims-to-raise-up-to-500-million-in-hong-kong-ipo-1453372440

[20] https://www.nytimes.com/2023/12/28/business/citic-trust-china-property.html

[21] https://static01.nyt.com/newsgraphics/documenttools/299e47ed0c64b0bb/262118f9-full.pdf

[22] https://hbr.org/1998/11/how-venture-capital-works

[23] http://www.zhongzhi.com.cn/en/about/companyprofile/index.html?type=1

[24] https://www.linkedin.com/company/hang-tang-wealth-management-ltd/about/

[25] https://www.linkedin.com/in/victor-wu-480990117/

[26] https://www.nytimes.com/2023/09/22/business/china-economy-trusts-zhongrong-zhongzhi.html

[27] http://www.zhongzhi.com.cn/en/about/companyprofile/index.html?type=1

[28] https://www.reuters.com/article/idUSL4N2T4046/

[29] http://www.zhongzhi.com.cn/en/about/companyprofile/index.html

[30] https://www.bbc.com/news/business-67890633

[31] https://www.bbc.com/news/business-49791721

[32] https://www.nytimes.com/2023/09/22/business/china-economy-trusts-zhongrong-zhongzhi.html

[33] https://www.scmp.com/business/banking-finance/article/3232760/jingwei-textile-top-shareholder-troubled-chinese-shadow-bank-zhongrong-plans-delist-due-significant

[34] https://www.nytimes.com/2023/09/22/business/china-economy-trusts-zhongrong-zhongzhi.html

[35] https://www.amtdgroup.com/en/pr_2016_06_16

[36] https://www.zritc.com/ZRTEN/AboutZRT/COMPANY_ANNUAL/201709/U020170925555741430726.pdf

[37] https://www.reuters.com/business/finance/top-shareholder-chinas-troubled-zhongrong-trust-plans-delist-2023-08-30/

[38] https://www.reuters.com/markets/asia/chinese-asset-manager-zhongzhi-says-it-is-liquidity-crisis-meeting-video-2023-08-17/

[39] https://www.reuters.com/article/idUSL4N2T4046/

[40] https://www.asiafinancial.com/two-executives-from-chinas-zhongzhi-missing-after-collapse

[41] https://www.asiafinancial.com/china-wealth-manager-zhongzhi-admits-to-64-billion-in-liabilities

[42] France24, Lundi 27 November 2023

[43] https://www.bloomberg.com/news/articles/2023-08-16/china-shadow-bank-crisis-sparks-protest-by-angry-investors?embedded-checkout=true

[44] https://www.asiafinancial.com/two-executives-from-chinas-zhongzhi-missing-after-collapse

[45] https://asiatimes.com/2023/11/zhongzhi-collapse-could-be-bigger-than-evergrandes/

[46] https://www.asiafinancial.com/two-executives-from-chinas-zhongzhi-missing-after-collapse

[47] https://www.bangkokpost.com/world/2629419

[48] https://www.ft.com/content/5948fd27-8195-4974-879e-125546112be3

[49] https://www.straitstimes.com/business/chinas-zhongrong-exposed-to-struggling-property-developers

[50] https://www.ft.com/content/5948fd27-8195-4974-879e-125546112be3

[51] https://www.yangoholdings.com/en/industry_sun.html

[52] https://www.ft.com/content/5948fd27-8195-4974-879e-125546112be3

[53] https://lavoceditalia.com/2023/12/01/704353/cina-spariti-due-alti-dirigenti-della-banca-ombra-zhongzi/

[54] https://theglobalpitch.eu/2022/01/16/indebtedness-in-chinese-translates-as-evergrande/

[55] https://www.ft.com/content/cff3f131-52af-4eaf-bacf-4ac49b5512ed

[56] https://www.ft.com/content/5948fd27-8195-4974-879e-125546112be3

[57] The Daily Caller, January 5th , 2024

[58] https://www.cnbc.com/2024/01/08/zhongzhi-latest-casualty-of-chinas-deepening-debt-and-property-crisis-.html

[59] https://www.cnbc.com/2024/01/08/zhongzhi-latest-casualty-of-chinas-deepening-debt-and-property-crisis-.html

[60] https://www.cnbc.com/2024/01/04/chinas-housing-inventory-may-take-more-than-10-years-to-correct-economist.html

[61] https://www.cnbc.com/2023/08/18/chinas-property-troubles-worsen-ramping-calls-for-bolder-policy-help.html

[62] https://www.bloomberg.com/news/articles/2023-10-25/country-garden-default-on-dollar-bond-declared-for-first-time

[63] https://www.cnbc.com/2023/08/18/chinas-property-troubles-worsen-ramping-calls-for-bolder-policy-help.html

[64] https://www.cnbc.com/2023/11/15/chinas-unfinished-property-projects-are-20-times-the-size-of-country-garden.html

[65] INDEBTEDNESS IN CHINESE TRANSLATES AS EVERGRANDE – The Global Pitch

[66] https://www.cnbc.com/2023/08/18/chinas-property-troubles-worsen-ramping-calls-for-bolder-policy-help.html

[67] https://www.cnbc.com/2023/12/12/china-vows-to-boost-domestic-demand-in-bid-for-2024-recovery.html

[68] https://www.cnbc.com/2023/12/12/china-vows-to-boost-domestic-demand-in-bid-for-2024-recovery.html

[69] https://www.cnbc.com/2023/12/07/chinas-big-property-market-problem-will-take-years-to-resolve.html

[70] https://www.cnbc.com/2023/12/05/moodys-cut-chinas-credit-outlook-to-negative-on-rising-debt-risks.html

[71] http://politics.people.com.cn/n1/2023/1024/c1001-40102519.html

[72] http://www.news.cn/2023-10/24/c_1129935679.htm

[73] https://www.cnbc.com/2023/10/12/china-should-boost-consumption-as-real-estate-slump-drags-on-imf-says.html

[74] https://www.jpmorgan.com/insights/global-research/international/china-deflation

[75] https://www.csis.org/analysis/chinas-slow-motion-financial-crisis-unfolding-expected

[76] https://edition.cnn.com/2023/12/11/economy/china-cpi-deflation-worsens-intl-hnk/index.html

[77] https://hbr.org/2021/05/the-strategic-challenges-of-decoupling

[78] https://www.ceps.eu/the-eus-aim-to-de-risk-itself-from-china-is-risky-yet-necessary/

[79] https://www.forbes.com/sites/miltonezrati/2023/12/29/chinas-deflation-another-tell-of-serious-economic-trouble/

[80] https://www.cnbc.com/2023/12/07/chinas-big-property-market-problem-will-take-years-to-resolve.html

[81] https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2022&locations=CN&start=2004&view=chart

[82] https://www.everycrsreport.com/reports/RL33534.html ; https://www.visualcapitalist.com/30-years-imports-us-trading-partners/

[83] https://www.reuters.com/markets/us/foreign-holdings-us-treasuries-august-hit-highest-since-december-2021-data-2023-10-18/#:~:text=Japan%20remains%20the%20largest%20not,TD%20Securities%20in%20New%20York.

[84] https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/workingpaper/2010-07-chinasavingrate_0.pdf

[85] https://www.theglobaleconomy.com/rankings/savings/

[86] https://www.ceicdata.com/en/indicator/china/gross-savings-rate#:~:text=Key%20information%20about%20China%20Gross,an%20average%20rate%20of%2045.9%25.

[87] https://www.reuters.com/world/china/part-chinas-economic-miracle-was-mirage-reality-check-is-next-2023-09-03/

[88] https://www.everycrsreport.com/files/20190625_RL33534_4b83865b1859fc8219e3c695fa4af0edc134db6b.html#_Toc12530867

[89][89] https://www.adb.org/sites/default/files/publication/224601/adbi-wp646.pdf ; https://documents.worldbank.org/en/publication/documents-reports/documentdetail/291521468179640202/the-middle-income-trap-turns-ten

[90] https://documents1.worldbank.org/curated/en/291521468179640202/text/WPS7403.txt

[91] https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=CN

[92] https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=CN

[93] https://www.ft.com/content/a998c1bc-7632-47c1-baba-6ccd6aaef96e

[94] https://www.ft.com/content/a998c1bc-7632-47c1-baba-6ccd6aaef96e

[95] https://edition.cnn.com/2024/01/30/economy/europe-dodges-recession-2023/index.html

[96] https://www.nytimes.com/2024/01/20/business/economy/economy-recession-soft-landing.html?auth=login-google1tap&login=google1tap

Leave a Reply