ACHIM WAMBACH: GERMANY’S WRONG

The war in Ukraine is catalytically transforming Germany’s industrial, export-oriented model. The performance of Europe’s growth engine has been the underlying story of the year for much of Europe. ‘How serious is the challenge at hand’ is the question. Seeking as straight an answer as one can get, we turn to Professor Achim Wambach.

Professor Wambach is both not only an analyst but has direct input in decision-making. Few experts have his strategic oversight over the German economy. He is the President of the Leibniz Centre for European Economic Research (Mannheim)– or simply ZEW – that is a point of reference for economic analysts. Until 2022 he was a member (and for some time the Chairman) of an expert committee with the mandate to advise the Federal government of the day on market regulation and economic policy known as the German Monopolies Commission. Finally, he is a member of the academic advisory board at the federal ministry of economic affairs and climate action.

For lack of a better word, he is a “technocrat” in a country that is knowledge-intensive across the board, including policy development. Professor Wambach has an eye both on the state of play and the direction of travel. We first sought him out in the autumn of 2022, as he had hands-on engagement in Germany’s response to the war-induced energy crisis. This is the right time to revisit, with a higher energy benchmark, and drummed-up fear of de-industrialisation. To top it all, the German constitutional court just shot down a 60bn Euros fund earmarked for Germany’s response to the challenge of transiting to a new energy model.

Germany needs to adjust, in a low growth environment, higher energy prices, fierce technological competition, and an insistence on zero debt: not a challenge for the faint at heart. Professor Wambach looks calm.

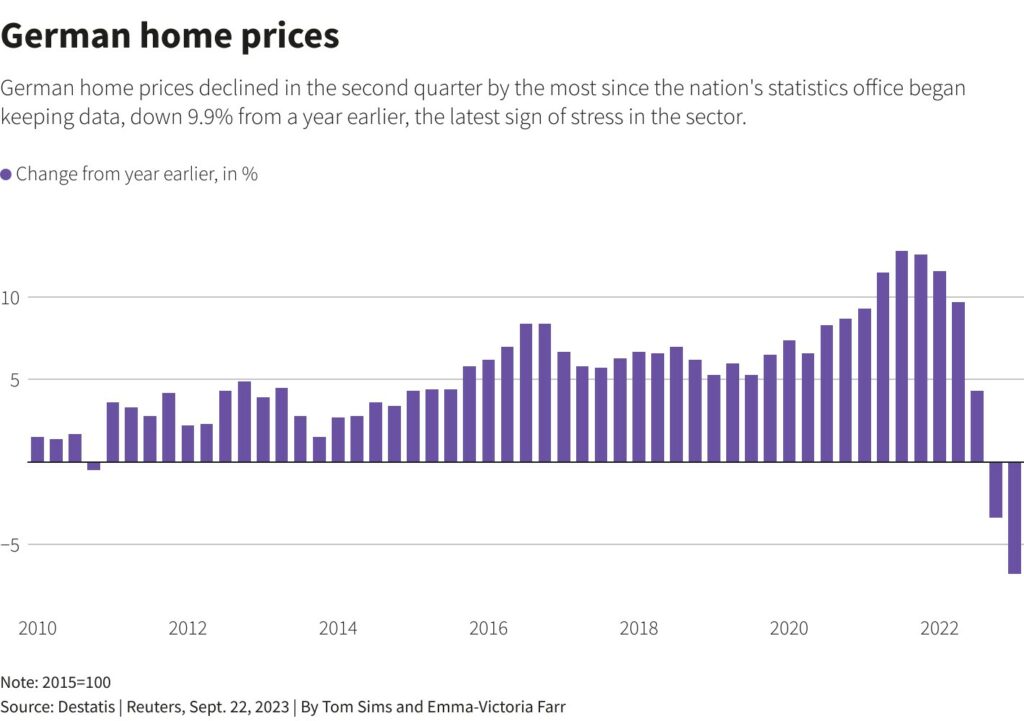

A key indicator: the development of the housing market in Germany[1]

Q1. Focusing on the short-term. In November of this year, you told the FT that expectations of lower inflation were changing the economic mood in Germany and there was something of a glimmer of light at the end of what looks like a tunnel. Lower inflation is to some extent the result of successive hikes on interest rates, designed to subdue consumption and price levels. Given that Germany’s economy depends more than others on industrial production of durable goods, like cars, can the German economy do well in a high interest rate environment? How do you see growth over the next six months?

Yesterday we published our {ZEW) December expectations forecast; it follows the November trajectory. One thing that did change is that nearly half of the experts consulted expect to see a decrease in interest rates. So, our forecast points towards growth, which to me came as a bit of surprise, following the Constitutional Court’s ruling that some of our “transition spending” the government earmarked for 2024 was not in line with our no-deficit rule.

By withdrawing the 60bn Euro earmarked for Climate Transformation expenditure, there is a 17bn Euro gap for 2024 that needs to be filled for the budget to work. That translates to a growth effect of about -0,5% of GDP. That was about the size of the growth we were expecting (0,7% of GDP); so, I was expecting this to brings us at the very minimum to stagnation. I suppose what the market expects is that lower interest rates will boost investment and fill that gap.

There are still unanswered questions, of course. It is unclear what happens to industrial subsidies {particularly energy}. The coalition parties have now agreed on how to deal with this gap in budget but details are still open. Companies are waiting for the level of subsidies to decide how they are going to invest. Companies in sectors that need to transform – steel, aluminium, etc. – need to have an understanding of the environment before they decide on their investment strategy. In sum, the overall investment climate is still very negative but the projection is going from negative this year to positive growth next year, but at a low level.

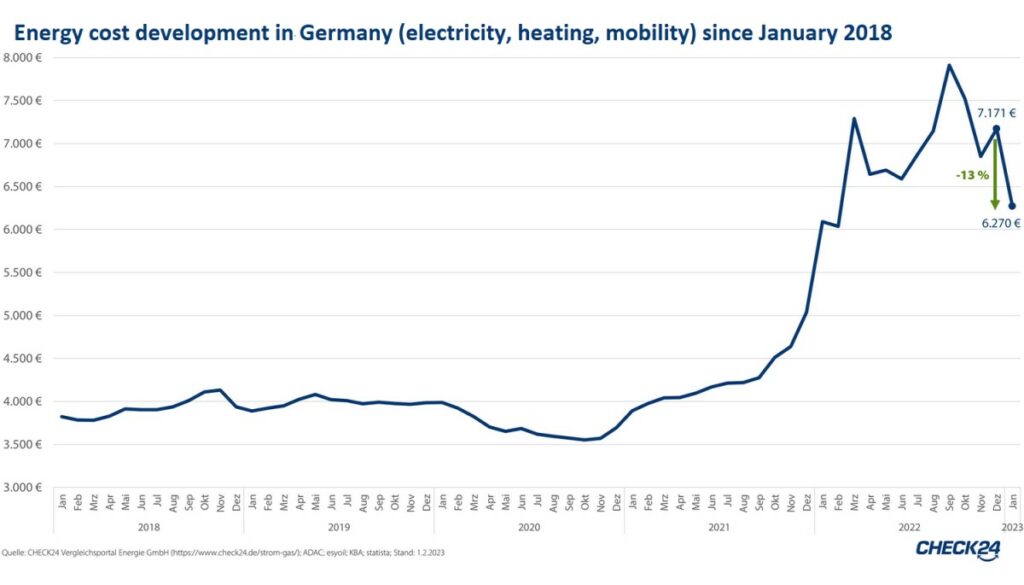

Development of Energy Costs in Germany[2]

Q2. Looking a bit on the structure of the German economy and the original question of energy. Energy prices in Germany are no longer competitive. When we last spoke in the autumn of 2022, you noted that the energy crisis was having a catalytic effect on the German industry, in that major industries were looking to relocate parts of their energy-intensive production (like Ammonia, in the chemical industry). We also seem to have a sense of protectionism in major markets, like the US. To what extend do you fear that a higher baseline of energy prices does raise the spectre of de-industrialisation? If you are seating in London thinking of deindustrialisation, you think of cities in the North that have not recovered after 30 years. If you are Germany today, what do you think?

My understanding is that at this stage we don’t have the data to fully understand the state of play in the economy right now. The overall trend is that industrialisation was slowing down across developed economies for two decades, but less so in Germany. To some degree, we base our reasoning on intuition, interviews, and ‘the word in the street.’

What is clear is that German energy prices have come down, but they are not likely to be subdued {to pre-war levels} in relative terms {compared to other major economies} at a competitive level.

Germany plans to invest in Solar and Wind. We don’t have the best air-fields in the world or indeed sunshine. Other countries will have more competitive energy prices. Consequently, the part of the industry that operates with low profits and is energy-intensive is likely to divest from Germany and relocate abroad because of (relatively) high energy prices. This is nowadays mostly uncontested. It will happen.

How large will this effect be? It is not clear yet. Germany was never strong because we are cheap. We are strong in high-quality specialised products. A large share of our industrial production has high value added, which also accounts for our high salaries. So, many of our industries will stay on. Inevitably, some of the industries will have to move abroad.

The other dimension of the question is what happens in the United States, with the Inflation Reduction Act subsidy programmes. We see some {German} companies shifting investments from Europe to the US. This is not a large trend at the moment but could pick up. That bill is also a signal that Americans take Climate Change seriously and there is money to be made if you have a technological competitive advantage.

So, German companies move not only because of the energy price levels but also because the Americans are signalling, they want to broaden the market. German companies invest in this sector both in the United States and China because these are high growth markets. There is no data to suggest that investment in the United States automatically translates into substantial divestment from Germany. So, there could be good news all around: investing in the US economy could prove good at a company level and would ultimately benefit employees in Germany.

Percentage of energy consumption in Germany[3]

Q3. Following your line of thinking. The European Commission industrial policy package seems to echo the needs of the German economy. A major energy importer – Europe and, proverbially, Germany – wants to reduce dependence on energy imports and invests in renewables (Net Zero Industry Act & Critical Raw Materials Act). First, can Europe move fast enough in that direction while also competing with China? Can we build a 5G network without Chinese technology, for instance, to recall the Huawei controversy in Germany? China also seems to be leading in technologies Germany used to, like Solar panels. In sum, can we compete and get there on time? Secondly, in November, the German constitutional Court frozen the 60bn Euro climate transformation fund. Can Germany have a tight zero-deficit budget and make the strides required to remain competitive?

Let’s unpack these questions one-by-one. I think The Critical Raw Materials Act is a well-defined response to a well framed problem and this policy package has a chance of getting us where we need to go. The MERCOSUR deal {between the EU and the biggest Latin American economies} is an integral part of that planning {because it secures access to critical resources at competitive prices}.

Now, looking at critical technologies. The objective of moving 40% of production in sectors which are relevant for the energy transformation to Europe… well, I do not see that happening. There is no budget backing this objective on a national level, neither is there one in Europe.

When it comes to renewables in Germany, Wind and Solar energy companies are making losses or barely breaking even. And the data points to a specific direction. Europe generally and Germany in particular have seen a surge in bilateral trade volumes with China over the course of 2023. That is not the case in trade relations between the US and China.

So, my reading of the situation is that when it comes to renewables, we will remain dependent on China, as they are cheaper than we are. Maybe in some advanced technologies German research could lead to a better value proposition and restore competitiveness. Subsidies for the current technology are not a sound industrial path, as China is too strong. Maybe in two to three generations ahead there will be a better case.

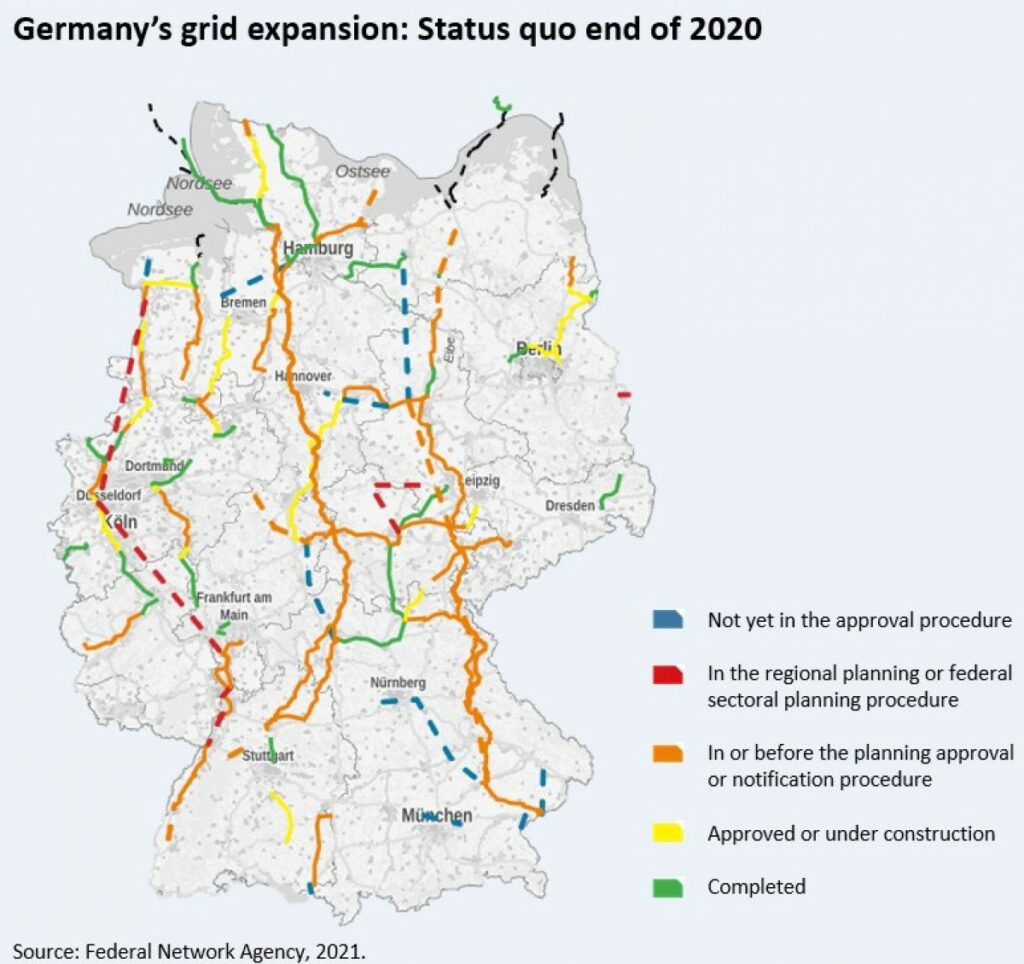

Development of new electricity grids in Germany in December 2020[4]

As to the question of how Germany moves forward with investment after the Constitutional Court Ruling, the advisory board at the federal ministry for economic affairs and climate action proposed that we move towards “Investment Associations” that will fund electricity networks and the further infrastructure we need: railway networks, digitisation, hydrogen, etc.

These networks eventually will be financed by the customer, whose bill always includes fixed use-of-network charges. You pay your electricity bill, you pay a charge for the grid, for instance, which makes sense.

The market invests too little in this infrastructure. One reason for this is the political uncertainty surrounding these investments. We propose to set up vehicles in which the government will be a strategic contributor, but not the sole contributor. This will help to raise private capital. The capital allocated in these ventures will be seen as a for-profit investment rather than expenditure, circumventing the constitutional limitations of the debt-break. So, there is a way to mobilise the capital without using the earmarked 60bn Euros.

IR. So, the grid is a priority.

Yes, we need to invest in a national grid – for instance, North-South to share Wind energy. However, we also need to invest in regional grids, bridging the countryside where electricity is generated from renewables, and urban centres where the energy is used. Thus far, urban centres produced energy on demand by fossil fuels. Now we need to be able to produce it where we can and consume it where we need it.

For the transformation you need more. The electrification of passenger and cargo transport evidently requires the expansion of rail networks. And we need to move fast on broadband. All this requires state support but, ultimately, the customer pays. For next year, we have a 17bn Euro shortfall, or 4% of the Federal Budget, or less than 0,5% of GDP. Now, that is substantial but manageable.

Q4. In March 2023 you argued that subsidies in the energy market is inevitable in times of crisis, as no one want to assume the social and/or political cost of a prolonged period of surging energy prices. You pointed to the fact that what Germany is missing is “base energy,” supply readily available on demand whatever the weather. Given that Germany is giving up on nuclear power, shuts down coal, and pipeline gas dried up, what did you have in mind?

Last year was special and very demanding, with extremely high price spikes in the energy sector. This year is looking much better. However, if the winter is harsher, we may encounter some of the issues we had to deal with last year. The war in Ukraine forced us to move from pipeline gas to LNG and that is an ongoing process. A return to a semblance of normality will take years.

The market points towards a model of an energy mix that will rely a lot on renewables and gas plants as backup. This hybrid model can work and at scale and prices will eventually come down but Germany is not likely to reach {industrially} competitive energy price levels. Not like France, for instance, that can deploy nuclear and can presumably secure cheaper electricity from solar and wind energy in North Africa. We are also unlikely to compete with the Americans and their access to Shale Gas. Frankly, we will not have cheap energy.

I would assume that if we are late in completing this work on renewables and on getting more flexibility into the German electricity system, we will continue to use the coal plants we theoretically want to retire. The planning is to use them until 2038, in some regions until 2030. But, if we need them, we will use them, as coal is a competitive fuel. Of course, coal will become more expensive because of CO2 charges.

The problem with the German energy landscape is in fact that there are too many “ifs” that is not the best guide to investment. Nuclear is out of the equation. Even if there was to be a new consensus on it (the Christian Democrats are now in favour of nuclear energy) it would take years to plan and build. Of course, we can and will use French nuclear energy.

Q5. Fundamentally, is Germany living through a normal economic downturn or is the surge in energy prices a challenge to its industrial export-oriented model?

We are in a downturn and we have a challenge to our model: it’s not an “or” but an “and.” The highest challenge is for energy-intensive industries. A big share of our economy is founded on smaller highly specialised companies. Cheap energy is not central to their profitability. There is of course a major challenge for the auto-manufacturing industry, historically relying on combustion engines. They are in crisis. But theirs is mostly a technological crisis rather than energy crisis.

If you see out stock market, you might say that profitability is recovering and our industry is adjusting. This is not an end in our industrial model but a change. We should recall what made the German industrial model so great. That model is based on innovation. We spend 3% of our GDP on Research and Development, which is a lot. Very few countries do that. So we are in a good position to do the transformation, which is about new technologies – even if we have to give up the combustion engine.

Unfortunately, our focus on subsidies does not account of this. I would like to see more subsidies on research and development rather than production. Europe has 10% of all emissions and 30% of all scientists. That’s where our future lies. It is not just reducing emissions, but inventing the new technologies to make emission reduction cheaper and better. The perspective should not be on the industry of today, but to make sure that we are leading in 10-20 years: the question is not to compete with the Chinese in solar energy, where they prevail today, but to be leading with new technologies further down the line.

GER024

[1] https://www.reuters.com/markets/europe/german-housing-prices-show-sharpest-drop-since-2000-yy-stats-office-2023-09-22/

[2] https://www.cleanenergywire.org/news/household-energy-prices-germany-continue-fall-remain-high-early-2023

[3] https://en.wikipedia.org/wiki/Renewable_energy_in_Germany#/media/File:Energiemix_Deutschland.svg

[4] https://www.cleanenergywire.org/factsheets/set-and-challenges-germanys-power-grid

[5] https://www.weforum.org/agenda/2023/09/economics-news-finance-inflation-gdp-growth-1-september/

Leave a Reply