SWITZERLAND BRINGS TRAFIGURA INTO THE DOCK

A few days ago, Trafigura and one of its former executives was accused in Switzerland, which is the country where the group’s operational holding company is registered, of bribing public officials in Angola in the years 2009-2011 and laundering money from illicit activities[1] . Corporate indictments in Switzerland are rare and convictions even more so, which adds to the clamour of this news. Switzerland has joined a series of actions against the global giant that trades oil, precious minerals, various metals and other ‘commodities‘ around the world. We have long followed the commodities trading sector and Trafigura is certainly one of its biggest players.

We have already written a lot about the suspicious activities of Trafigura (and its many subsidiaries) throughout its existence[2] , and asked how it is possible to turn a blind eye to the environmental disaster in Côte d’Ivoire (2006), the transport of toxic waste and the explosion of an oil tanker in Norway (2007), a financial scandal in Brazil with multi-million dollar bribes, involving 42 other countries and the Brazilian President (2013)[3] , new corruption episodes in Congo, the advance payment of raw materials by Côte d’Ivoire (a nation under pressure from Trafigura’s monopoly and huge debts) and the suspected violation of restrictions on oil exports to embargoed countries such as South Sudan, Iran and Cuba… just to mention a few cases, as the list is really long[4] .

The bribery charge

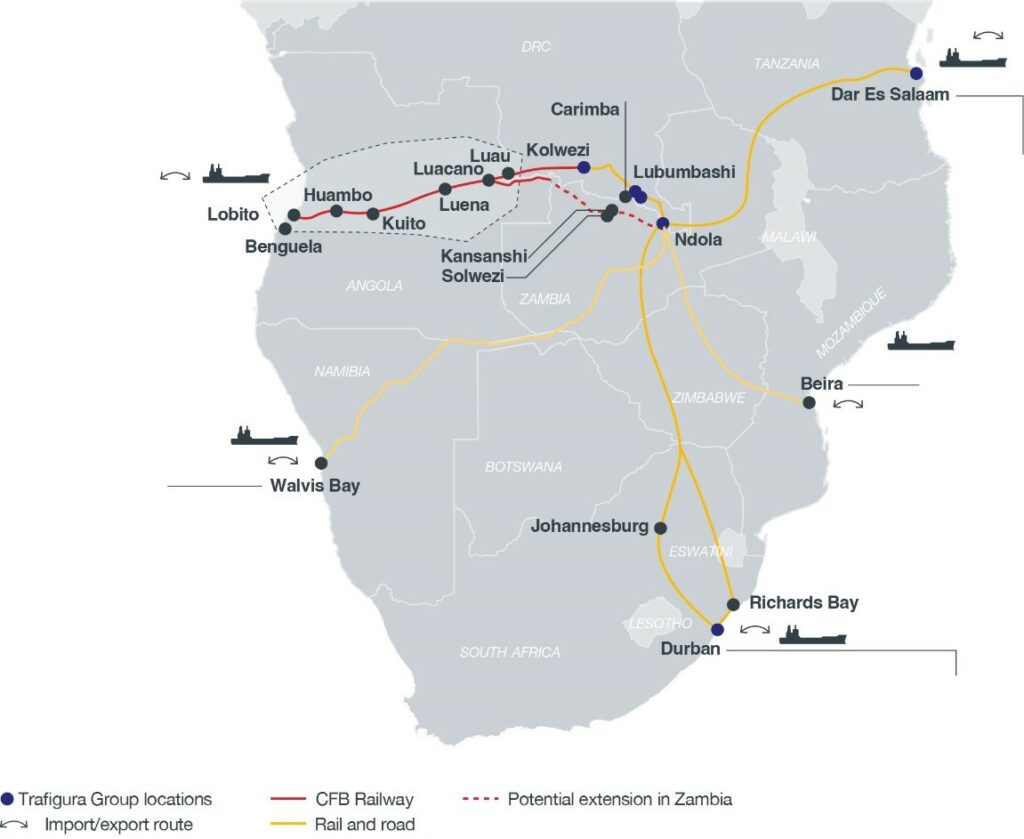

The giant logistics system operated 100% or as a member of a consortium by Trafigura, and linking the Angolan hub of Lobito to all of Trafigura’s commercial ports in sub-equatorial Africa[5]

The Swiss attorney general has indicted Trafigura Group and its former long-time CEO, Mike Wainwright, for failing to take the necessary measures to prevent bribe payments in Angola between April 2009 and October 2011. Through its subsidiary, Trafigura Beheer BV Amsterdam, and an offshore company, the Group paid EUR 4.3 million (USD 4.6 million) into a bank account in Geneva and a further USD 604,000 in cash, plus accommodation and restaurant expenses during a visit to Geneva (a further CHF 800)[6] , to an Angolan official from the country’s oil industry[7] , and to a former employee of the state-owned company Sonangol[8] , who has also been indicted.

At the time, the Trafigura Group was particularly active in Angola in the ship chartering and bunkering sectors. Its most important counterpart was the Angolan government and Sonangol EP and its subsidiaries, in particular Sonangol Distribuisora SA, responsible for the distribution and marketing of petroleum products. In return for the money received, the Angolan civil servant allegedly favoured the group’s interests. Thanks to the proceeds of these contracts, the group has allegedly realised profits of USD 143.7 million to date[9] .

This is the first time that a case against a company for alleged bribery of public officials has reached the Swiss Federal Court. Trafigura Beheer BV and former CEO Mike Wainwright reject the charges[10] . Jeremy Weir, Group CEO, says: ‘We are sincerely sorry about these incidents, which violated our code of conduct and are contrary to our values. For many years we have worked hard to instil a culture of responsible conduct at Trafigura. Since this period, we have significantly improved our compliance programme and controls. This includes mandatory training for all staff, continued investment in a global compliance team, and our decision in 2019 to prohibit the use of third parties to create business.”[11] .

It is true that contracts in the commodities market (very often) are obtained through the work of local intermediaries who have access to local governments, industries and entrepreneurs – always on the borderline between personal influence, professionalism and corruption. And in July 2019 Trafigura was forced to review its relationships with third parties, and eliminate all intermediaries with the intention of improving the situation[12] . At least ostensibly, because in 2022 the Group signed a new princely logistics contract with the Angolan state and, as our cover photo shows, there were plenty of middlemen[13] .

If Mike Wainwright is found guilty, he faces a potential large fine or a maximum of five years in prison. Earlier this year, Trafigura had announced his retirement, scheduled for March 2024, but now Wainwright has been forced to step down immediately – he is currently on leave to concentrate on his defence[14] . In the meantime, the Group is reshuffling some management positions with the need to replace Mike Wainwright, and the transition to a new generation of global managers will be anything but easy, especially after Wainwright’s management has had to endure a few more stinging defeats[15] , such as the loss of shareholder control and the billion-dollar fine decided by the Belgian courts for the Nyrstar case[16] .

Old and new cases

A world map of Trafigura’s most controversial business cases[17]

Trafigura is trying to parry blows and faces corruption investigations in the US, Brazil and Switzerland. In its official press release of 6 December 2023, the Group separately disclosed a US Department of Justice (DOJ) investigation into ‘improper payments‘ in Brazil (notorious Car Wash operation[18] ), expects to resolve it ‘shortly’, and stated that it intends to make a provision of USD 127 million in its accounts to cover any financial damages resulting from the US investigation[19] .

The Swiss charges come as Trafigura is facing the embarrassment of a fraudulent nickel deal. In February 2023, a London court heard allegations that the trader failed to monitor nickel shipments – and may even be involved in more serious crimes. Indian businessman Prateek Gupta claims in a court document that Trafigura employees collaborated with his companies to keep secret an agreement to replace scrap and other low-value metals with nickel, confirming this with copies of chat exchanges and emails with Trafigura staff. According to Gupta, Trafigura’s head of nickel trading, Sokratis Oikonomou, devised the scheme, and Mumbai senior trader Harshdeep Bhatia knew what was going on[20] .

According to Trafigura, things turned out differently. The group revealed that it recorded a charge of USD 577 million in the first half of 2023, after discovering that some nickel cargoes received (from more than a thousand freighters) did not contain the metal, but carbon steel: a case of ‘systematic fraud’. Trafigura initially inspected the containers in Rotterdam, but the rest were destined for ports around the world. The fraud was committed by a group of companies related to and controlled by Indian businessman Prateek Gupta, including TMT Metals and companies owned by Gupta’s UD Trading Group[21] . Trafigura has been doing business with this Gupta family for years, so the Group has initiated legal proceedings against Gupta and the companies involved in the scam. The price of nickel doubled in March 2022, reaching a record $100,000 per tonne, after the main nickel producer, Russia, invaded Ukraine[22] .

It seems that the Group is losing steam on all sides, despite growing profits (by 73% as of June 2022; and they were already at a record 80% in June this year[23] ) due to the invasion of Ukraine, which has put a strain on supply chains, particularly for oil, gas and refined oil products[24] . The Group, together with other traders such as Vitol, continues to help export oil from Russia, despite sanctions[25] .

In Europe, the case of Nyrstar NV, which in 2018 was the second largest zinc smelter in the world (1.073 million tonnes), after Korea Zinc (1.216 million tonnes) and ahead of Glencore (1.003 million), has finally been resolved[26] . After the restructuring orchestrated by Trafigura, which took possession of the company’s shares in an opaque manner[27] , Nyrstar NV became only a shell company with 2% of the historical industrial activity. Thanks to its new role, Trafigura took advantage of advantageous business contracts[28] , but unfavourable to Nyrstar[29] . Minority shareholders have launched legal action: they claim that Trafigura has illegally used its influence to negotiate contracts unfavourable to Nyrstar[30] , and that these agreements have caused the economic disaster of the Belgian group[31] . Trafigura now owns 24.42% through Urion Holdings (Malta) Ltd, a direct subsidiary of Trafigura, which was legally acquired – and the rest is in the hands of Belgian businessman Kris Vansanten and minority shareholders[32] . A total victory.

It is too early to tell whether this is a series of coincidences, or a sign that the wind is, at last, changing, but for the writer, it is enough to be able to hail a series of clear, unambiguous decisions in defence of the law, which until a few years ago seemed unthinkable. Whatever the courts decide in which cases against Trafigura’s management are heard, the fact is that the giant is no longer impune, and that the King, at last, is naked.

ESP027

[1] https://www.bloomberg.com/news/articles/2023-12-06/trafigura-charged-in-switzerland-over-alleged-angola-bribery ; https://globalinvestigationsreview.com/article/trafigura-indicted-in-switzerland-over-angola-bribery-claims

[2] Search results for ‘trafigura’ – The Global Pitch

[3] https://www.reuters.com/markets/commodities/trafigura-sets-aside-127-mln-provision-brazil-us-doj-fine-2023-12-06/

[4] TRAFIGURE: WHY WE SHOULD FEAR IT – The Global Pitch

[5] https://www.trafigura.com/news-and-insights/case-studies/metals-and-minerals/lobito-atlantic-railway/

[6] Trafigura-Aktivitäten in Angola: Anklage gegen Rohstoff-Unternehmen wegen Korruption | Handelszeitung

[7] Trafigura Charged in Switzerland Over Alleged Angola Bribery – Bloomberg

[8] Statement regarding investigations by US, Swiss and Brazilian authorities (trafigura.com)

[9] Trafigura-Aktivitäten in Angola: Anklage gegen Rohstoff-Unternehmen wegen Korruption | Handelszeitung

[10] Trafigura Charged in Switzerland Over Alleged Angola Bribery – Bloomberg

[11] Statement regarding investigations by US, Swiss and Brazilian authorities (trafigura.com)

[12] Statement on the company’s decision re the use of third parties for business development (trafigura.com)

[13] https://www.trafigura.com/news-and-insights/press-releases/2022/concession-agreement-signed-with-the-angolan-government-for-rail-services-and-logistics-support-for-the-lobito-corridor/

[14] Trafigura Charged in Switzerland Over Alleged Angola Bribery – Bloomberg

[15] Commodities trader Trafigura revamps senior leadership – CityAM

[16] https://www.rsqinvestors.eu/post/call-for-a-fundamental-overhaul-of-the-governance-of-the-legal-advisory-industry ; https://financiallawinstitute.ugent.be/wp-content/uploads/2022/11/2022-18.pdf

[17] https://theglobalpitch.eu/trafigura/

[18] TRAFIGURE: WHY WE SHOULD FEAR IT – The Global Pitch

[19] Statement regarding investigations by US, Swiss and Brazilian authorities (trafigura.com)

[20] Trafigura staff knew about nickel fraud, Gupta says in court document By Reuters (investing.com) ; Trafigura accused of multimillion trading cover-up in London’s High Court (ft.com)

[21] https://www.reuters.com/markets/commodities/gupta-asks-court-lift-freezing-order-trafigura-nickel-fraud-case-2023-12-05/

[22] Trafigura faces $577m indictment after alleged nickel fraud – CityAM

[23] Oil, gas and LNG drives Trafigura to record £4.4bn half-year profits – CityAM

[24] Trafigura’s profits rise to $2.7bn following surge in commodities price – CityAM

[25] Trafigura and Vitol could step up trade in Russian oil, CEOs admit – CityAM

[26] Leading zinc smelters worldwide 2018 | Statista

[27] NYRSTAR: THE GIGANT’S AGONY IN THE ARTS OF TRAFIGURE – The Global Pitch

[28] Trafigura accused of throttling Nyrstar with lopsided zinc deals (miningweekly.com)

[29] What really killed Nyrstar NV? Shareholders have a strong case against Nyrstar’s board and Trafigura – Iceberg Research (iceberg-research.com)

[30] Minority Nyrstar shareholders file €1.48B lawsuit against Trafigura | S&P Global Market Intelligence (spglobal.com)

[31] Nyrstar Shareholders Launch Lawsuit Against Trafigura | INN (investingnews.com) ; a6d8ea_c0d8b55f3d8e4d58bc121aa9ab6cfaa7.pdf (filesusr.com)

Leave a Reply